I’d like to share an anecdote from my personal life which is quite relevant to the world of finance, inflation, and economics. Specifically, I am endeavoring to purchase a house in Durham, North Carolina. I don’t intend to live there (well, hardly ever). It’s an investment property.

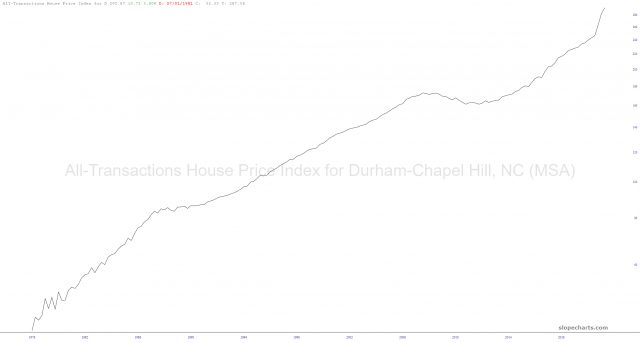

Before I dive into my experience, I present to you a trio of charts that SlopeCharts was kind enough to provide. First is the price index in Durham since the late 1970s, which is up hundreds of percent.

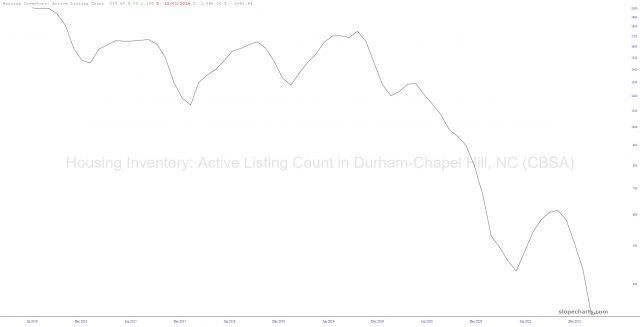

Next is the actual inventory of houses being made available for sale (which, paradoxically, is absolutely plunging in the face of skyrocketing prices).

Lastly is the price-per-square-foot, which is a nice, normalized way of getting a sense as to what home values are doing irrespective of home size.

Now, one would assume, based on my long-time residency in Palo Alto, I would be battle-hardened against real estate pricing insanity. Well, not really.

See, when we bought our principal residence, it was 1991 during a recession. Even then, the price would seem expensive to most of the rest of the country (“$542,000? Wow, in Bumblefuck, Iowa, where I live, you could get a 20-story mansion with that kind of money!” <—I heard something like this endlessly). But we scrapped together what we could and managed to buy it.

When we bought it, not only did we NOT face multiple bids, but the house had been sitting for months, unsold. Indeed, they dropped their price form something like $605,000 down to $557,000 (that may not be to the penny, but it’s very close) and we Presbyterianed them down to $542,500. So it was more of a matter of seeing how LOW we could get the price and still get a deal, and it was very, very low pressure. The only struggle was on the part of the seller, since they felt they had “lost” by way of dropping the price.

It goes without saying that it was the best investment of my life, and we often remark how we could never, ever afford this glorious home we live in, since it’s worth about fifteen times more than we paid for it. The whole thing worked out great, and it was very calm and undemanding.

Not so with Durham. Although the nominal prices are obviously quite different (indeed, very similar to the kinds of prices we were observing in our fair city of Palo Alto back in 1991), the pressure is off the charts. And I’m not talking about Durham in general. Hell, if you get ten miles outside of the town’s center, you can secure a 3.2 acre property with a gorgeous house and maybe even pay below the asking price. It’s a cinch.

But get close to the downtown, where it’s hip and cool, and where we want to buy – – it’s absolutely pandemonium.

We started off rather naively. We were told it was a really hot market, so we figured, meh, fine, if the ask is 550k, we’ll go nuts and bump it up to 555k and pay them even MORE than they want. Well, that didn’t fly. Because, unbeknownst to us, if the ask is 550k, people were cheerfully bidding 650k, 670k, and even higher, so we lost bid after bid after bid.

And, with each loss, we got more aggressive. I’m sure the scrum of other people who kept getting the “no” were doing the exact same thing. In other words, we were collectively making things WORSE for ourselves by bidding higher and higher percentages above the ask in order to have a fighting chance, and to this very day, we haven’t won a single bid.

The worst thing about this process is the lack of transparency. I am accustomed, on a day to day basis, of knowing to the PENNY precisely what any given financial instrument can be purchased or sold for. Some markets are more efficiency than others, of course, and as you saw with my portfolio spreadsheet from earlier today, the bid/ask on options can be nice and tight (less than 1%) or outright grotesque (33%). But at least you know what’s going on, because the price discovery process is transparent.

But in this process, you are absolutely shooting in the dark. If a place has an ask of $500,000, the only way you can be pretty sure to get it is to simply say Fuck It All and bid something insane, like $800,000. And, as far as you know, the second-highest bid was $570,000, which means you’re an idiot. Added to which, they are legally forbidden from TELLING you, even if you win the bid, what the second-highest one was.

So it’s fantastic for the sellers, because they are dealing with a public that is frantic to buy SOMETHING, and they’re getting increasingly frustrated in doing so. I mean, thank God almighty that we don’t actually NEED to buy anything. This is a totally optional investment. Most of these poor people bidding alongside us need, ya know, an actually HOME TO LIVE IN.

Of course, developers aren’t stupid, and they are scurrying around town (which is most parts is a pretty shitty town, with a long history of working class, run-down homes) and gobbling up ANY property they can and replacing it with something nice. In fact, the only places that aren’t selling are those which, yes, look nice if you crop out all their surroundings, but are in fact in pretty crappy neighborhoods. In fact, one house that simply isn’t getting any heat right now is this one, in which case they didn’t even bother chopping out the gargantuan power tower right next to it.

Most of the realtors are a bit more sneaky about tightly zooming in on the nicest looking portions, such as this very new construction:

But, see, before they built it, the exact same location looked like this: (hey, nice radar dish installation there!)

And it is still SURROUNDED by neighboring houses that look like this:

So, umm, saying that this property is “overbuilt” for this neighborhood would be exceptionally kind. Because anyone living there is going to feel like a goddamned freak, and I wouldn’t be surprised if they got robbed and/or burgled about every third day. or so.

In any case, I am venturing out to the great state of NC next week and will be spending a few days there with boots on the ground. I will also, as typical, warn all you people about my travels, and apologize for my lack of content, which will be only five times greater than other sites, as opposed to the ten times greater you’re accustomed to seeing.

My point is that, when buying a house, being in a Seller’s Market sucks out loud. I just know we’re buying into a bubble. All I can say is that I’m glad I’m overpaying in a market of half million dollar houses instead of ten million dollars ones.