Crude’s Fallen Arches

Good morning, everyone,. I’m pleased to be back in Palo Alto and surrounded by my monitors again. I’m particularly delighted to see so much red on the screen, even though, based on last Friday’s knitting-needles-through-eyeballs insanity, I’m waiting for the proverbial other shoe to drop (or shall I say other shoe to float up in the air, because that’s about how much sense the Post-Draghi-WTF-Rally made).

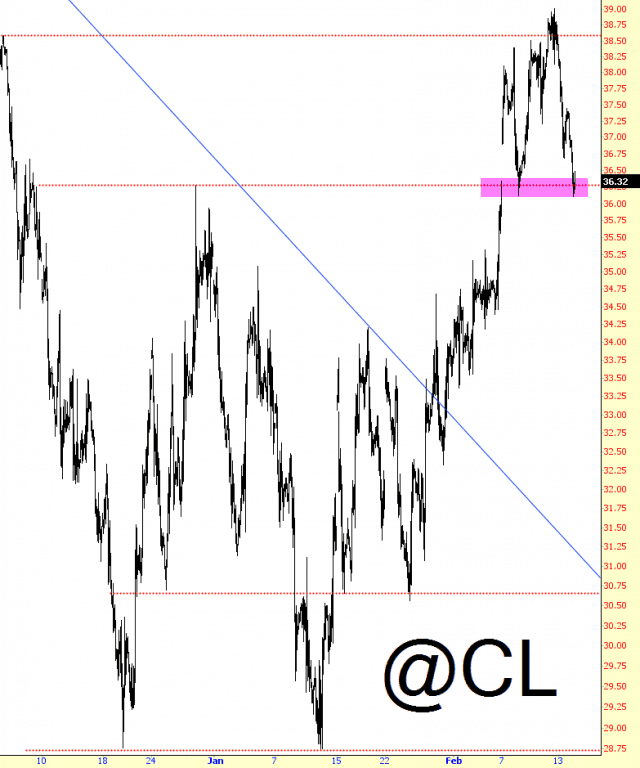

Crude oil in particular has been getting fricasseed lately, and we are at a crucial juncture, which I’ve tinted. When crude first whooshed past this area on March 7, energy bulls were thrilled at the breakout. This breakout level must hold, however, otherwise we have – – yes, you guessed it — a failed bullish breakout, which sets us on the path to the low 30s.