Like most non-insane people, there are some things I like about myself and some things I don’t. Over the nearly ten years I’ve been writing this blog, I have tried to be candid (within reason) about my shortcomings and personal frustrations, but there’s one thing in particular which I don’t like that has been very much on my mind: my aversion to learning new things.

A love of learning is a crucial part of growth. It’s not like I enjoy ignorance – far from it – I immerse myself in news and information 365 days a year, and I consider myself deep into the 99th percentile in terms of being informed. This is different from learning something new, however. By the latter I mean such an undertaking as learning a new language, acquiring a new skill or, most relevant here, learning a new approach to trading.

As almost all of you know, I am a dyed-in-the-wool permabear. I take no particular joy in this fact, but it does seem quite deeply-rooted. That kind of predisposition doesn’t exactly serve one well most of the time, and I have long been looking for some kind of salvation to make me a more balanced trader.

I have actually tried quite hard on this, but, at heart, I am a chartist, and most of the things I’ve looked at do not “sing” to me the way charts do. Molecool, for instance, has built from what all accounts is a terrific, cold-blooded, steely-eyed system that cranks out profits. I’ve looked at it multiple times. It just doesn’t speak to me. It may be ungodly profitable, but I can’t feign interest. There have been other systems like this, and I just don’t get into any of them.

I even, with a close friend of mine, built a system I never told any of you about called Risk Farmer, which was a fantastic (from a technical perspective) tool for selling options premium. Its problem was that it would generate ten instances of good small profits and then a single horrible loss, thus wiping out all the profits and then some. So, for obvious reasons, we shelved it.

For years I’ve been on this quest and Dutch, God bless him, has been gently prodding and coaxing me to try out binary options. Reluctant, stubborn, pigheaded soul that I am, I have basically blown him off for the past three years. But even though I only read about 1% of the comments that stream through the site, I had seen enough success stories about Dutch and his methods that I just couldn’t take it any more: I had to have a look.

Starting only a couple of weeks ago, I started learning what I could, and I liked what I saw. In fact, the more I studied it, the more excited I became. This was something which I could actually see myself doing, and it was a total departure from my normal methods. The fact that there was even the prospect of me getting out of my rut was invigorating for me. I spent last week doing trades in a paper account (in other words, a demo account), and every stinking trade was profitable. I opened up an account and funded it with a modest balance.

I am not here to sing the praises of binary trading. Indeed, I have made (and lost) precisely $0.00 in this entire effort, because I haven’t even done my first real trade yet. I intended to do so today, but I did not, which is why I’m writing this post.

One thing that has held me back is the utterly irrational fear of having my first trade be a losing one. It’s totally silly, but I have this hangup that I’ll somehow “spoil” everything if I venture into this zone of apparently neverending profits and muck it up somehow, or just happen to hit the oh-so-rare losing trade from bad luck. It’s dumb, but there you have it. I want to be as confident of a winning first trade as I can, just to have a good start.

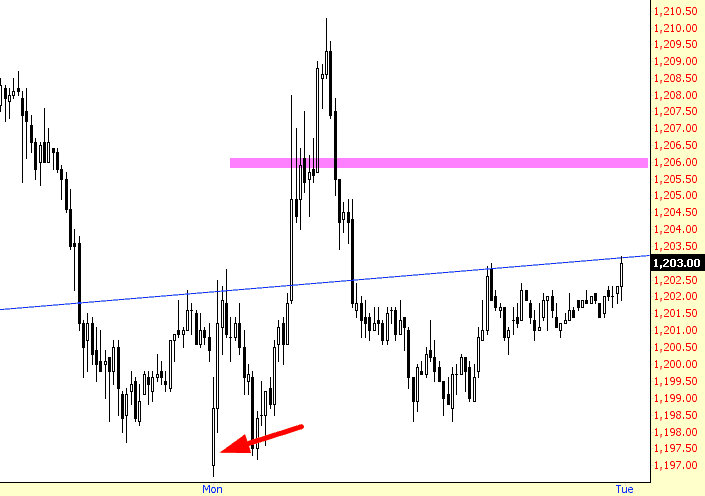

So, this morning, the first “signal” came (since this is all after the fact, I don’t think I’m speaking out of school by mentioning these trade signals): to “sell” the gold option at 1206. In other words, the bet being made was that, by day’s end, gold would not be above 1206.

Well, gold was already down hard, and it seemed altogether possible to me that gold could easily close above 1206, so I did nothing. Gold began to strengthen, and it got above 1206, and I patted myself on the back for dodging a bullet. I started to wonder if these binary ideas were all so wonderful after all. But – – hold the phone – – gold resumed sinking, and, sure enough, at the end of the day, it was below 1206 (the arrow approximates the signal, and the pink line denotes the “true” level, beneath which gold had to close for the trade to win).

So, lesson number one for me – – it’s OK to get a signal, decide to wait it out, and seek a better price. Indeed, my charting skills could have been useful here, because had I watched the chart closely, I could have picked a spot that I was indeed comfortable with, and not only would the trade wind up profitable, but much moreso than when the signal was first issued. This was heartening because, frankly, I don’t want to just blindly follow signals. I want to participate and add value.

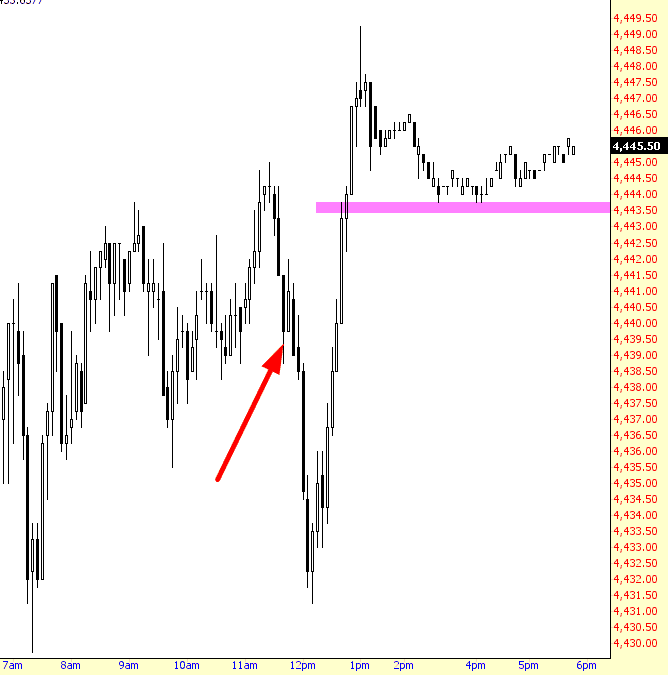

In the midst of this, I began to wonder if I should execute a trade based on my own idea, so I decided to “sell” NQ below 4444 end of day; in other words, I’d win if, at day’s end, the NQ was below 4444. I actually put in the trade, but I didn’t get my price, and I got a little jumpy about running with my own idea in this new area, so I cancelled it.

Now too long before the close, another signal was sent by Dutch & Company suggesting a “buy” on the exact same index. I scoffed at this and decided I would do no such thing. The NQ started to sink and, just as with the GC early in the day, I patted myself on the back for wisely avoiding this trade. But – yep, you guessed it – the NQ started soaring, and the trade wound up “true” – that is, profitable. Below is the chart, once again showing an arrow when the idea was proffered and the pink line indicating the required level it needed to close above.

So I got two lessons out of this to add to the one mentioned earlier in this post – lesson two was to not inject myself into this. In other words, if I want to work a better price, that’s just dandy. But it’s way too early in the game to be conjuring up my own ideas (particularly since my bearishness is already well-reflected in my own portfolio), and lesson three was that I really should just follow the signals, whether I agree with them or not.

The good news, for me, is that even though I didn’t do a single trade today, I took away three valuable data points, and my enthusiasm for trying out binary trading isn’t diminished one iota. In fact, I’m kind of glad I screwed up (by failing to take the two trades) since it was really eye-opening seeing how things unfolded.

This is not a panacea, of course. I saw Phantom Capital express some very well-reasoned concerns about binary options, including the thin volume and spreads wide enough that Oprah might even be able to walk through them. I’m ready to give this a second go tomorrow, though, and actually get going with my first trade. Perhaps over the coming weeks I can keep folks apprised as to my progress and my attempts to – gasp – actually learn something new for a change!