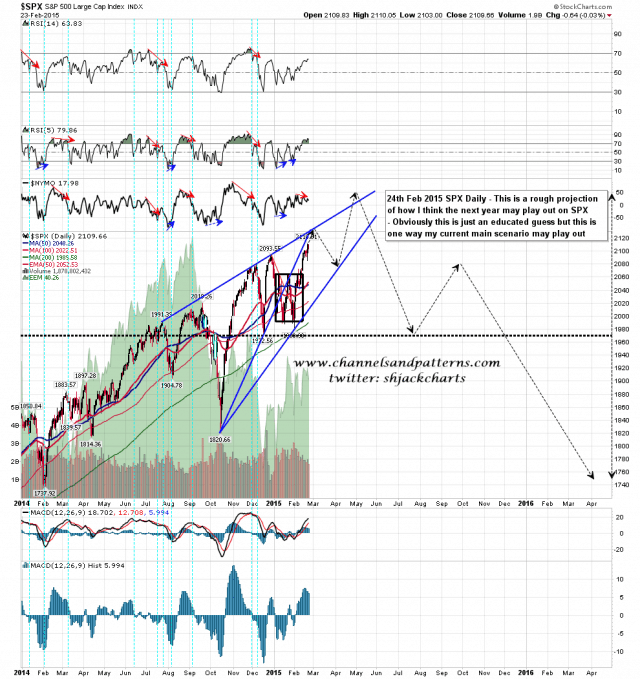

I’m ready to do a projection of what I am thinking may well happen on SPX over the next twelve months. My main scenario is this, and variants of the same scenario. It’s a good fit with the pattern structure, and the first month indicator for 2015 that indicated strongly that 2015 would at best be a flat year.

Does this match any other forecasts that I’m reading? Well no, most are far more bullish and they could be right, but I posted an even more minority view projection for bonds at the start of 2014 to general incredulity, and price followed my arrows very well for the next six months as everyone betting on the almost universally expected big bonds decline got a very nasty surprise. We’ll see whether this projection fares as well as that one did. SPX daily projection 150224:

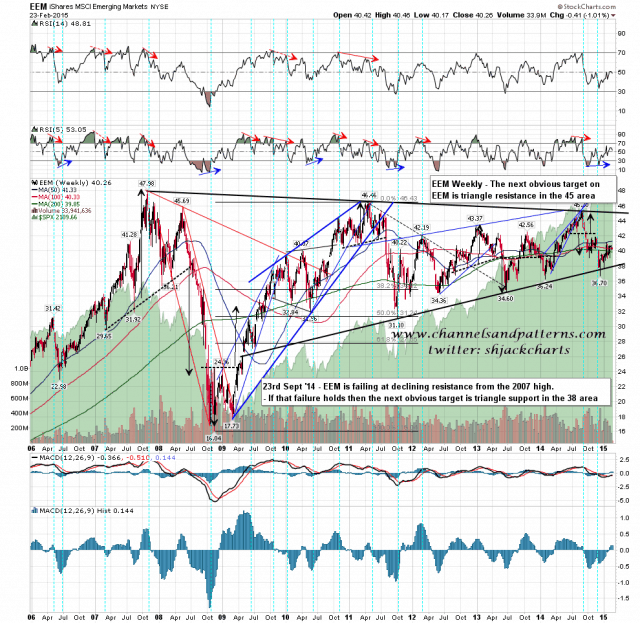

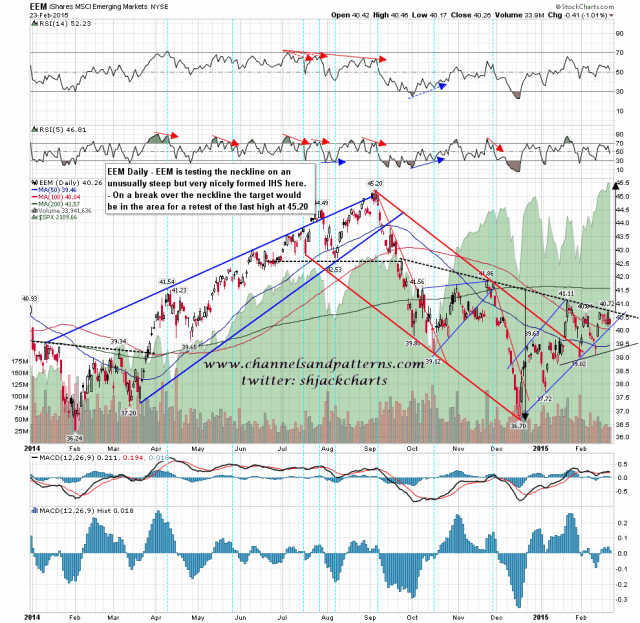

No much else to add on SPX today after yesterday’s inside day candle so I’ll look at EEM today. I posted a chart last September saying that the obvious next target on EEM was triangle support in the 38 area. That overshot slightly and reversed back up. The next obvious target is triangle resistance in the 45 area. EEM weekly main chart:

Will EEM get back to 45? I think so but there is a significant hurdle to overcome on the way as EEM is currently stalling at IHS neckline resistance. On a sustained break over that neckline the IHS target would be in the 45.2 area, so that should deliver that triangle resistance hit. This neckline is a possible failure area however, so we need to see that neckline break. EEM daily main chart:

SPX is in a sideways consolidation and that may continue for another day or two, and on a break below yesterday’s low we could see a move to retest the 2095 area. We may well break up earlier though, and as and when SPX does break up from here, my target at wedge resistance is in the 2125-30 area.

I have an important update on oil that I haven’t had time to include today and will be posting that on twitter in the next hour.