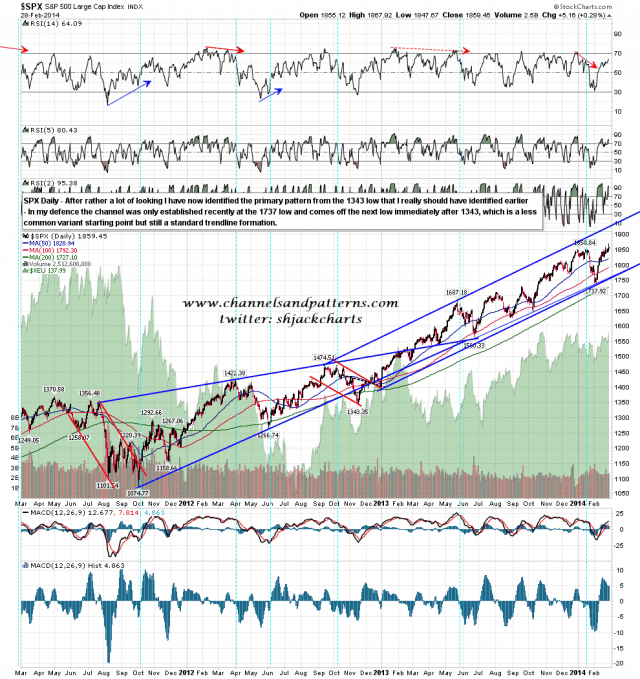

Russia was taking steps to secure post-imperial interests in Ukraine over the weekend, and while there seems little chance that there will be any armed response from the West, it seem likely that this can be the trigger for a much needed short term retracement from the SPX weekly upper bollinger band, which was tested at the high on Friday.

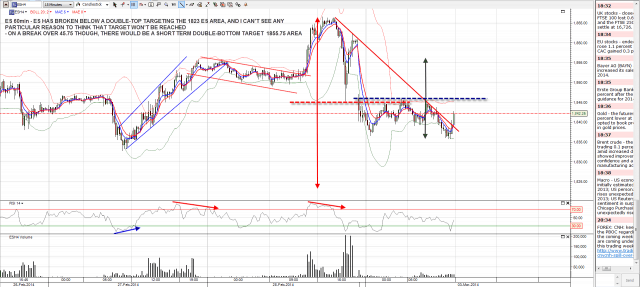

On the ES chart a double-top has broken down with a target in the 1823 area, and I can’t see any particular reason to think that target won’t be hit except …….. that a smaller double-bottom has formed which would target the 18955.75 area on a break over 1845.75. Only one of these patterns should play out and I’m leaning strongly towards the bear option, though obviously I’ll be watching strong resistance in the 1845/6 area with interest. ES 60min chart:

For those of you who may have missed my weekend post you can see that here, and the bottom line is that I have now identified the current primary bull market pattern with high degree of confidence, and that is a rising channel with channel resistance currently in the 1920-30 , and rising at about 25 points per month. SPX daily primary patterns chart:

Primary short term support on SPX is still at the 50 hour MA, which closed on Friday at 1848. A clear break below that, which we may well see at the open, would back up the double-top scenario here, and the obvious initial SPX downside target would be the possible H&S neckline at 1824.