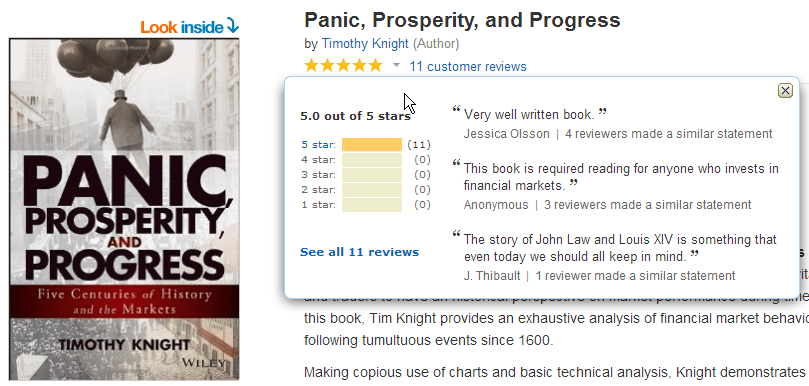

First, a bit of shameless promotion – in case you missed the first 97 times I mentioned it, my book Panic, Prosperity, and Progress is available at Amazon for 40% off. Click here to go there; as you can see, the reviews are pretty favorable! (I briefly sold signed copies at the full retail price, but those are sold out already).

Now, on to our regularly-scheduled posting from Biwii………..

In 2001 my financial adviser advised that the people running my IRA would never allow the type of losses that I myself would suffer by trading. Ehhhhhh… wrong! -50% in a heartbeat. Thanks MFS. My wife got a 60% haircut compliments of Putnam.

I spent some time calling these fund companies pulling money out and putting it back in the markets. In other words, I day traded them successfully, taking advantage of the bear market until finally I yanked every last penny from said financial adviser and his lame mutual fund companies and went DIY. A couple years later biiwii.com happened and the rest is history, and a gain of several hundred percent on that IRA.

Anyway, preamble aside, this market has the potential to be like that phase where you successfully short the market, buy the market, short the market; i.e. trade the swings. Take the QQQ chart for example…

Yesterday’s failure below the 50 day moving averages brings on a potential scenario that would see a further decline, a rebound off the noted support in April and a hard rise into May. In this scenario the bull soothsayers would gather themselves and cheer lead a hope rally. They might even rally the market above the 50 day MA’s.

But as it looks now, we will expect a lower high that forms a right shoulder on the Cubes and other indexes. 2014 has been expected (by NFTRH, anyway) to be a pivotal year and it is going to be a fun one. What was not fun was the robotic rise out of Q4 2012.

Speaking personally, I nailed that thing when said financial adviser above (an extended family member) noted the best and brightest fund managers were all in cash because of the impending Fiscal Cliff. My response… “BULLISH!”

I repeat this as is a perspective thing though I failed to maximize that call because of my fundamental beliefs about policy making and its relationship to the stock market. Whatever, it’s all water under the bridge.

What we have shaping up now is a 2014 with the potential to reward swing traders because if it sticks to the macro pivot plan, the topping action is going to include some awesome drops and titillating recoveries. And this time I do not have to go through the clunky process of calling MFS and Putnam to jerk funds in and out of the markets.

The trend will probably change in 2014. The swings will be traded but a difference from the last 5 years is that with a downward bias (if the macro analysis is correct) I’ll be trading in line with my personal beliefs and bias (with respect to policy making), not against them. 🙂