The bulls finally rediscovered their mojo and broke the very strong

resistance at 1102 ES yesterday. SPX also closed above the 200 daily

SMA, and in my view that makes it unlikely that we will be revisiting

the lows in the near future. For my money, the interim low is now

confirmed as in, and the question is how far this rally will go.

In the short term ES bounced off rising trendline resistance at the high

yesterday, and as I write is retesting the 1102 level. That may well

now prove good support, but if it breaks I see a possible fall to the

next strong support level in the 1084 area, which is also close to

probable rising channel support. If we get there I'll be seeing that as a

buying opportunity:

I've been looking hard at the SPX 15 min chart and on that I'm looking

at the recent trading range as a rectangle with a target at 1164 ES and a

possible IHS with a target in the same area. I have a strong uptrend

resistance line, as with ES, but support looks mushy and undefined. I'm

hoping that trading over the rest of the week will confirm a tradeable

rising support trendline:

On the SPX daily chart with my model bear scenario, I've marked in the

broken 200 SMA line and also the break yesterday of the 50 level on RSI,

both very bullish signals. If we were to rise over the next two weeks

to my model target, that would be in the 1164 SPX area as well, and that

is the primary scenario that I'm considering now:

Vix broke down to under 26 yesterday and I've marked in a declining

resistance trendline on the 60min chart that I am expecting should hold

for the duration of this rally:

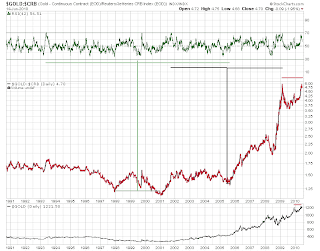

NYMO is probably the most interesting chart that I was looking at last

night. Here's the daily chart showing that we have moved from extremely

oversold to extremely overbought over the last three weeks. If you look

at the chart, a move as fast as this from under -100 to over +80 has

happened only twice in the last three years, once in the October 2008

rally, and again at the March 2009 low. The November 2008 to Jan 2009

move is also worth a look though:

This confirms in my mind that we have made a very significant low,

though it is obviously very ambiguous over whether the move up that we

are watching now is a rally or a move to new highs. I favor the former,

but I'm bearing the latter possibility in mind too.