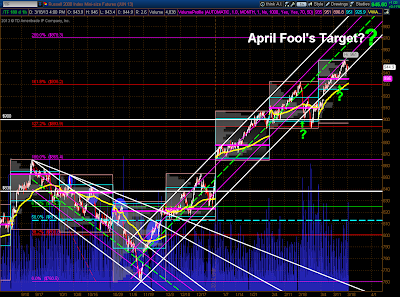

Like the zigzag roads that the Romans built in order to ascend mountains, the market continues to wind its way upwards, as demonstrated on this 60 min (market hours only) chart of the Russell 2000 E-mini Futures Index (TF).

At the moment (Monday's close), price has been generally confined to the uptrending channel. Until we see that trend broken by a series of lower highs and lows (with deeper drops), we'll likely see that continued, as the markets (backed by the Fed's unprecedented monetary easing and asset purchase programs) seem to be adept at fending off negative global and domestic news and economic events, including perceived threats of negative contagion. In other words, the markets appear to have the mentality of "Id imperfectum manet dum confectum erit." — "It ain't over until it's over."

However, the notion that "government 'theft' of bank depositors' savings could not spread to other countries and would not be a concern anyway, because money tied up in the markets is not sitting in a deposit account and is, therefore, safe from a similar fate" would be naive or ill-conceived. The mere fact that this has been conceived for one country is evidence that such a scenario exists for others as an unformed probability and is subject to the irrefutable laws of nature. The Law of Attraction dictates that belief in and acceptance of such a possibility will be attracted to that source. Ultimately, force never ends well and what happens in life is eventually reflected in the markets.