Hello fellow Slopers! I have been a longish-time lurker (about 4 years now) and was recently anointed by Knight Tim to contribute by writing articles. Since this is virgin territory for me on SoH, please be kind, gentle Slopers.

I have been playing SQNM for a quite a while and published some fundamental analysis here here and played its earnings here here for a nice meal. Now I’m going back to the same trough to pick up some more scraps.

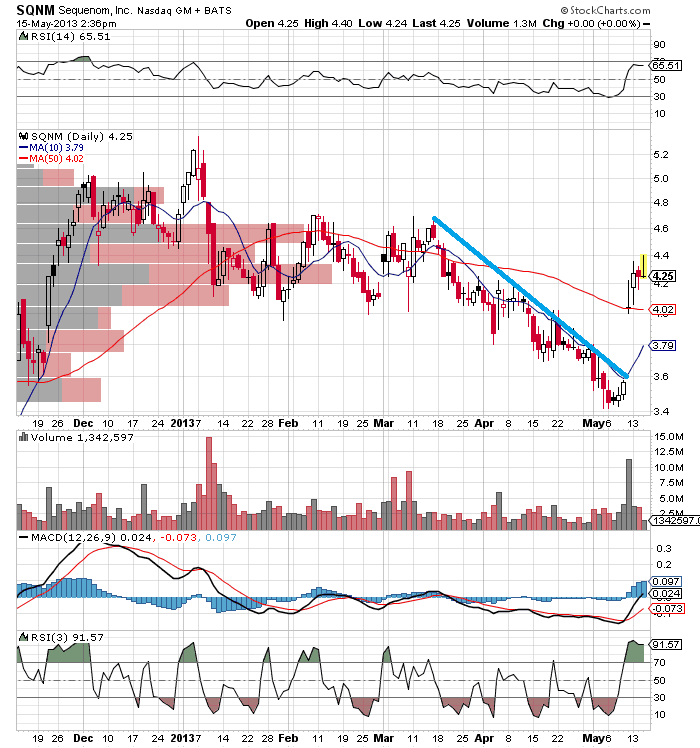

Looking at its chart, there are technical positives and negatives for SQNM. Long Negatives: (1) the 3-day RSI is screaming overbought; (2) there’s a big gap to fill from the earnings release; (3) SQNM has shown no strength to break through the current volume pole at $4.20 – $4.36; (4) it has a volume pole ending at $4.62 that it will need to break through to make a much bigger run to the upside. Long Positives: (1) the 50-dma provided solid support Monday; (2) short interest on this was last seen to be ~30% and highly shorted stocks have been squeezed higher over the last few months (though not SQNM, until earnings); (3) company’s revenues are making solid gains Q/Q; (4) the declining trend line from mid-March has been broken; (5) it is dithering it’s largest recent volume pole.

My more fundamental analysis tells me that SQNM’s business is doing well, which should imply that the stock is more likely to trade higher rather than collapse through the balance of the year. One way to play this would be to sell the June $4 puts, currently trading at $0.22/0.24. If the stock stays above $4, you’ll pocket a nice 5% return in a month. If it decides to fill the gap, you’ll be break-even down to $3.78, after which you’ll need to wait for a bounce off of the gap fill.

Follow me at www.protectedreturns.com. Happy Trading!