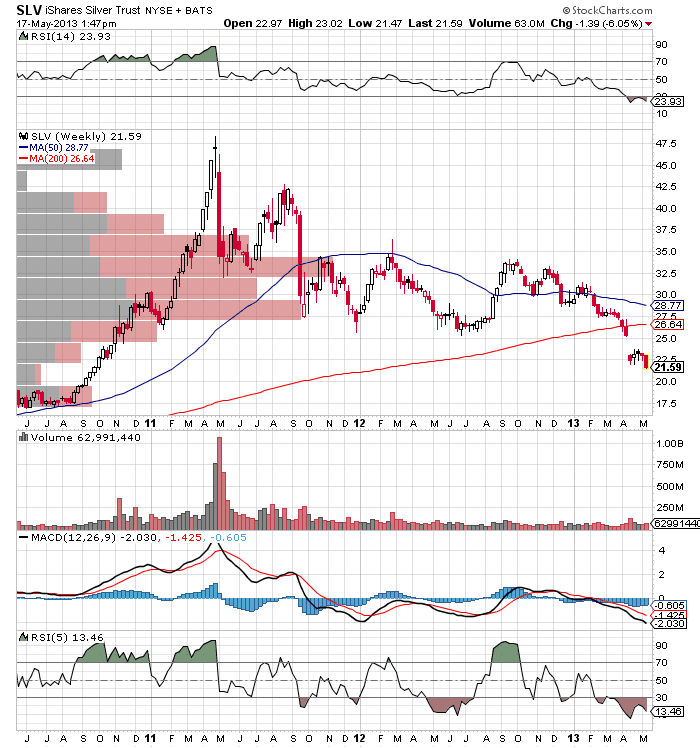

This post may draw the ire of precious metals trumpeters on Slope (ahem – “Kooks” – editor), but silver looks exceedingly vulnerable to me here, at least in the intermediate term. It has already slipped off the small volume pole that was holding it around $22.50 and is now solidly in a volume hole. I don’t see much stopping SLV from getting down below $20, at which point it will find a home in the $17.50-18.50 range for a bit. If it slides off that pole too, we will hear a collective liquid metal scream.

What would give me pause is that SLV is well into oversold territory on the 5-day RSI and also on the 14-day RSI. There is little to stop this from getting down to $17.50-19.80, however.