One of the amazing things about the Slope of Hope community is that, a number of years ago, it actually created its own “meet-up” in the form of SlopeFest. Slopers were so eager to meet one another that they drove or flew from various parts of the country and gathered at various locales around the United States. I’ve been at a few of these, and it’s pretty amazing getting face-time with those that are on Slope so often. I know them by avatar, but in-person is a whole other experience! (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

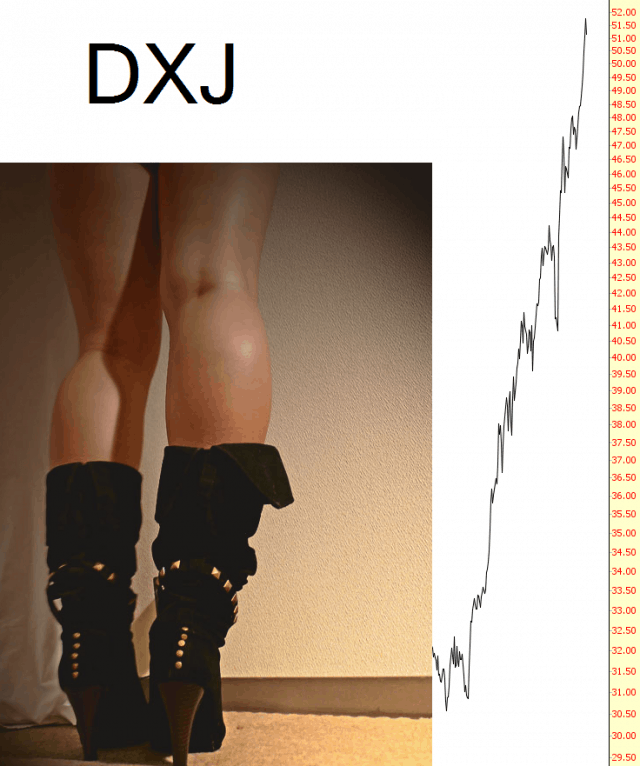

Shorting Japanese Hockey Stick

I haven’t monkeyed around with Japan for a long time, but the Nikkei’s ascent (fueled entirely by a crushing of their currency) is just plain dumb. I’m shorting this ridiculous move by way of DXJ, which is a hybrid of both their currency and their stocks. Because the graph’s ascent is so sharp, I had a lot of empty space, so for no particular reason I’ve put in a picture of a Japanese woman’s legs wearing boots. So to you fetishists out there: you’re welcome.

Over Loved, Over Emotional, Over Bullish

We have a bunch of economic data on tap for the market to get emotional over. Jerk to the left, jerk to the right; as if any one period’s data is anything other than a reason to game a market running on pure momentum.

And then we have Huey, Dooey, Louie and even a couple more popping out to dump even more signals on the market as we go full frontal Jawbone today: (more…)

May 16th, 2013 E-mini Prep Work

Heading into today, from a market profile standpoint we really only have the last two sessions to look at for guidance. Once again we are heading into a gap down situation and look to be opening within a 3-5pt range which has a 73% probability of filling.

Support: High volume node- 1647.50, Weekly R2 pivot- 1648.00, Low volume node- 1648.50, Value area low- 1649.00

Also note that this was the area of yesterday’s breakout. A long trigger off this level puts the gap fill in play but also is accepting the breakout and lower value which is defined by the VAL and low volume node.

Resistance: Value area high – 1659.00, relatively high volume node at 1659.25 and yday’s high – 1659.75

Here are the charts:

The key levels to pay attention to as the market heads into the middle of yesterday’s range and gap fill level are the overnight low at 1650.00, volume point of control at 1655.00 and the high volume node at 1653.00.

Should be good action today. Keep in mind news at 10am and 1030am EST.