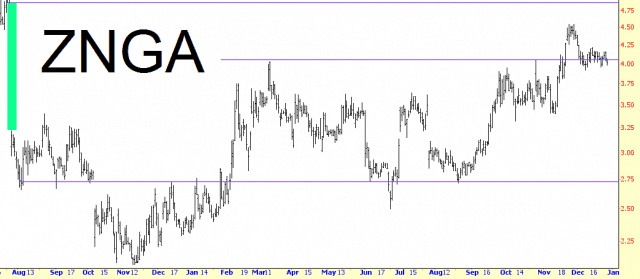

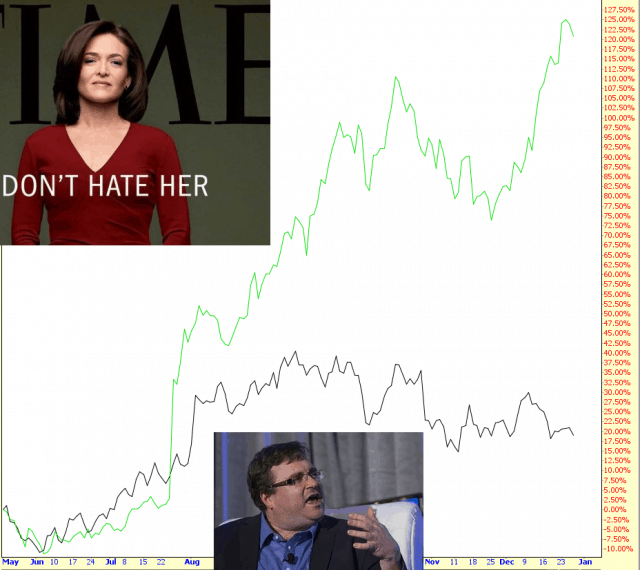

Just a one-chart music…….along the same lines as my LinkedIn post, it just seems to me that as amazing a year as this has been for social media stocks, Zynga’s performance, relatively speaking, has been pretty sad. It did a decent job filling its gap (represented by the green tint), and my hunch is that it’s just going to languish in the low single digits, with occasional barfage along the way. This company peaked, I’d say, just before it IPO’d.