When I finished writing my history book (which is coming out in February), I had a much deeper perspective on some of the great manias in financial history. In the modern age, Bitcoin has provided us a new South Seas, Dutch Tulip, and John Law all wrapped into one, and I’ve been stunned at the doe-eyed innocence that the press has given the “currency.” Its recent loss of about 55% of its value in the span of a few weeks is no huge surprise. My guess is that, within a year, this will be $100 or so once more. People. Never. Learn. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

A Close Look at Utilities

As boring as the Dow Jones Utility Average might sound, it’s actually a fascinating little beast. It provided the most gorgeous topping pattern imaginable back in 2007-2008, and it behaves itself quite well with respect to its trendlines and Fibonaccis. Observe the chart below and take note of the Fibonacci fan lines, which date back for many years. This particular line has acted like a magnet for the entire recovery, and recently it has been banging against it, respecting it as support each time. (more…)

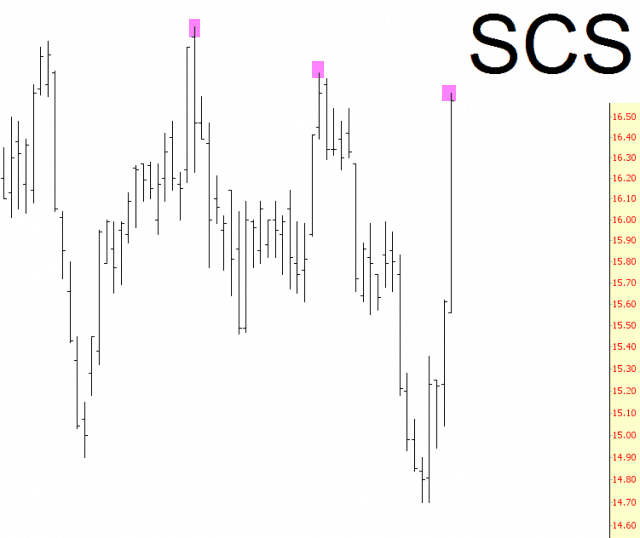

Open and Shut Steelcase

Just a quick idea to throw into the hopper – Steelcase. They announced earnings this morning and went flying higher. I shorted into strength and already have a nice little profit on this one. With the risk of the earnings announcement out of the way, I like the risk/reward on this one.

One Painful Squeeze

It’s hard to feel sorry for a guy with a billion bucks, but Bill Ackman has suffered a pretty devastating humilation with the entire Herbalife debacle. About a year ago, HLF tagged $23.63. Now, only a year later, it’s up about 250%. This quote kind of sums it all up (more…)

Brazil Nicked But Not Cut

Back on the 10th, I had offered up the Brazil fund ETF as a short idea, based on its clean pattern and neckline. Well, yesterday’s explosive rally did nothing more than affirm the strength of this pattern, because the neckline was challenged but not breached. This morning, we opened lower, and I have even more faith in this idea than when it was first suggested. (more…)