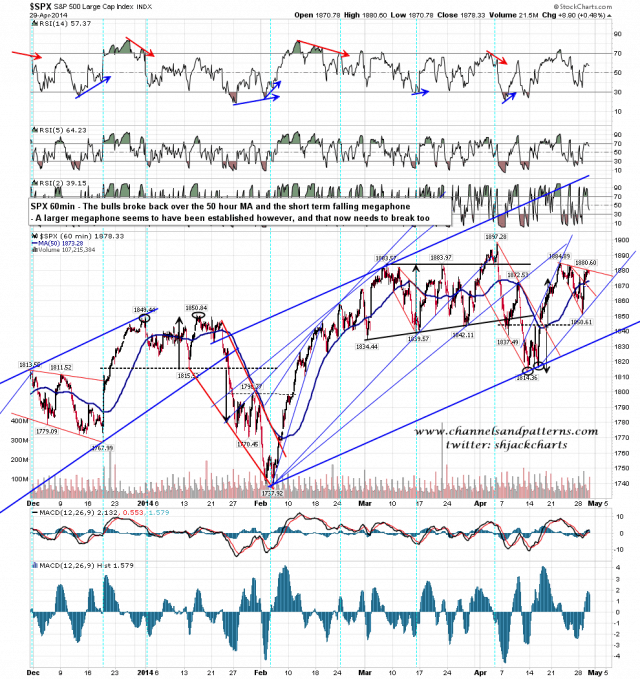

Yesterday was more tedious than I expected , though the bulls made some significant targets, notably the 50 hour moving averages on both SPX, now at 1873 and ES, now at 1868, so in effect at the same SPX level. The action yesterday looked somewhat bearish in the afternoon, and a new falling megaphone has been established, which I posted on twitter last night. If we see weakness this morning, which seems likely, then I will be looking for possible support at 1873 SPX. SPX 60min chart:

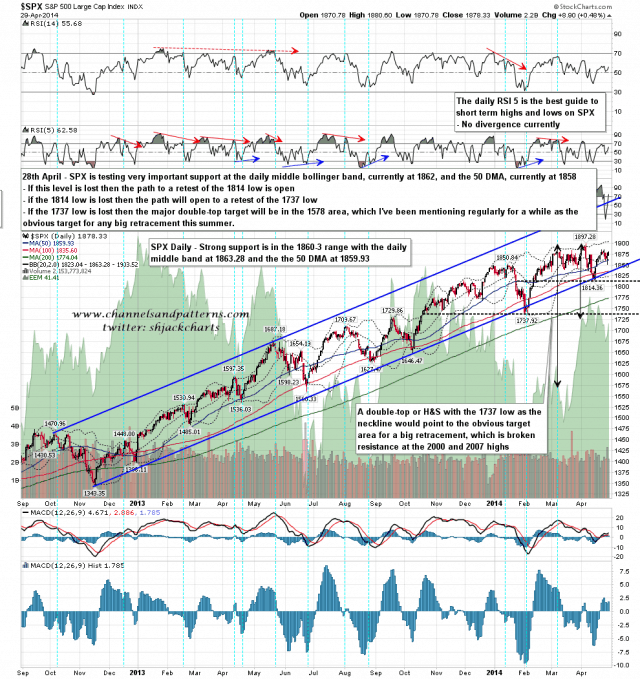

If SPX breaks back below the 50 hour MA, then I have the next serious support in the 1860-3 range, with the daily middle band at 1863, and the 50 DMA at 1860. This should be very strong closing support, though we could see a move underneath intra-day. SPX daily chart:

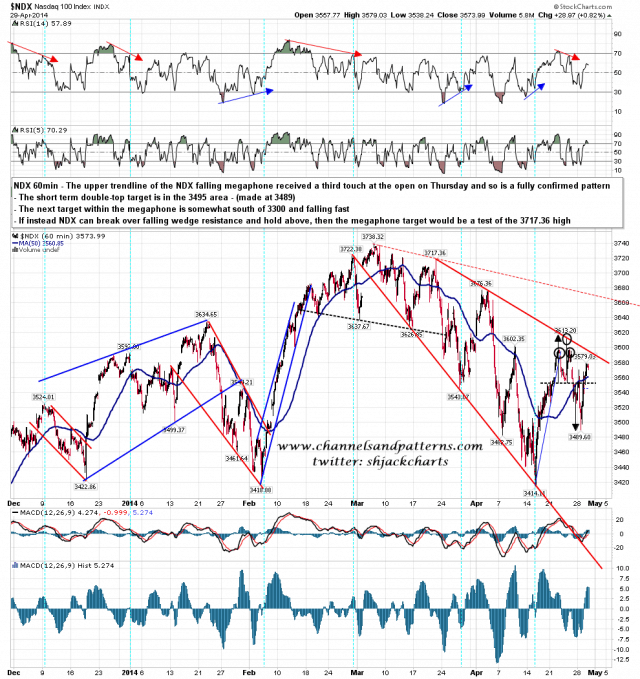

What the bulls failed to manage yesterday was to break over resistance on the large falling megaphone on NDX. If we are to see a test of the 1897 high on SPX, that would most likely be a prerequisite. After we see a low today, if indeed we see some retracement, the bulls will most likely get another chance to break up from the NDX pattern this afternoon or tomorrow. NDX 60min chart:

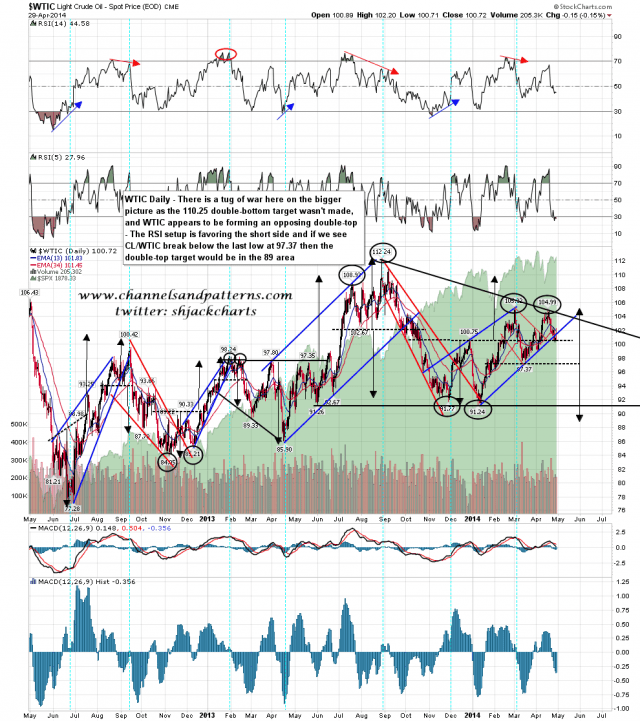

Oil bounced as I was suggesting yesterday morning, but failed hard at the daily middle band, and has now broken megaphone support on both the USO and CL charts. I’ve updated my WTIC chart to show the slightly ambiguous setup here, but as I mentioned yesterday, overall this has me leaning short on oil. The next obvious target is a test of the 97.37 low, and on a break below that I would have a double-bottom target in the 89 area. I have drawn in a possible descending triangle that might well give strong support in the 91.25 area. WTIC daily chart:

For today I’m leaning towards seeing some retracement that may be confined to the morning but may equally last much of the day. The SPX support levels that I will be watching are in the 1871-3 range, and then the 1860-3 range. I would be very surprised to see a close today below 1860. FOMC today, a heavy news week, and Thursday and Friday are both historically bullish. After any retracement is done I’d be expecting to see a run up into the NFP numbers on Friday.