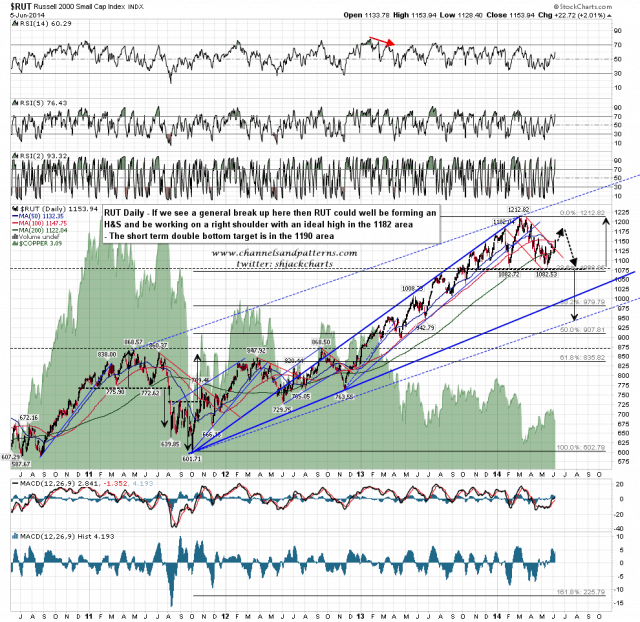

I said yesterday morning that I’d be impressed by a push up that broke the falling channel on RUT, and it broke up hard yesterday. I was duly impressed. The double bottom target is in the 1190 area and this updated version of a chart I posted last week shows the possible option that RUT is forming the right shoulder of an H&S with an ideal high in the 1182 area. The 1190 area is the obvious next target on RUT. RUT 60min chart:

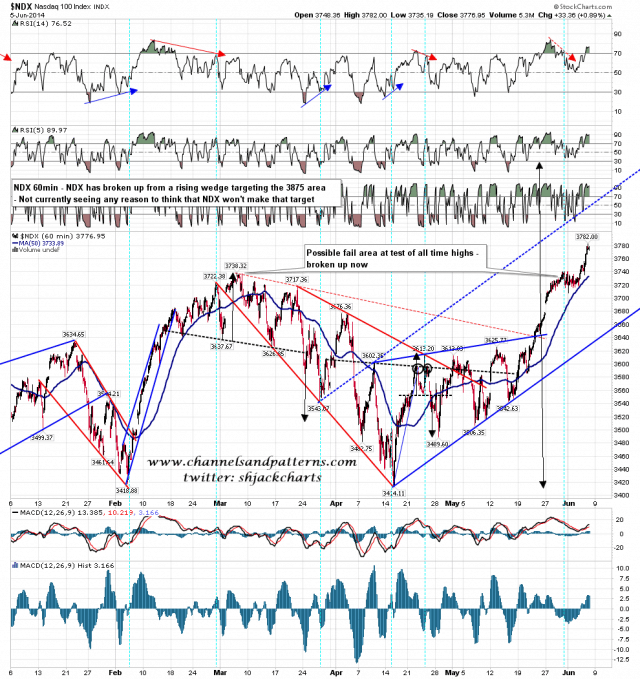

On Wednesday morning last week I gave the rising wedge target on NDX in the 3875 area and I was watching the retest at the previous all time high as that was a possible fail area. NDX consolidated there, but broke up yesterday and the obvious target now is that 3875 area target. NDX 60min chart:

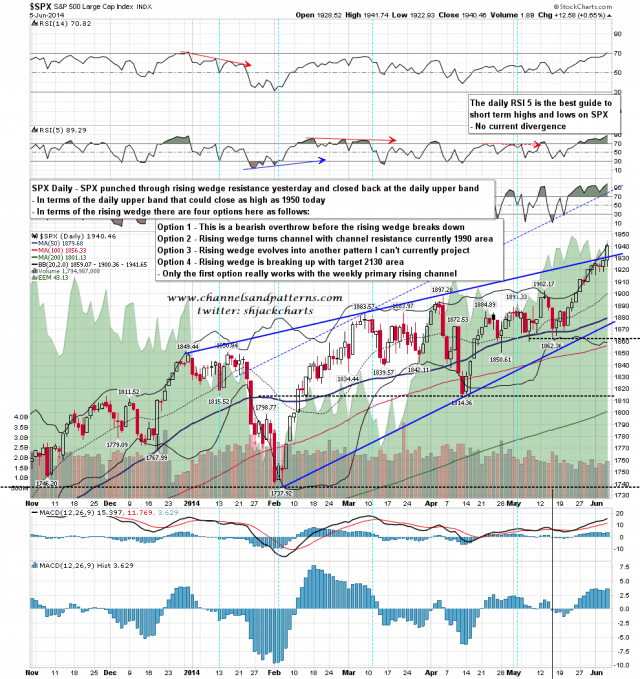

SPX closed back at the daily upper band yesterday and the upper band could close as high as 1950 today. SPX daily chart:

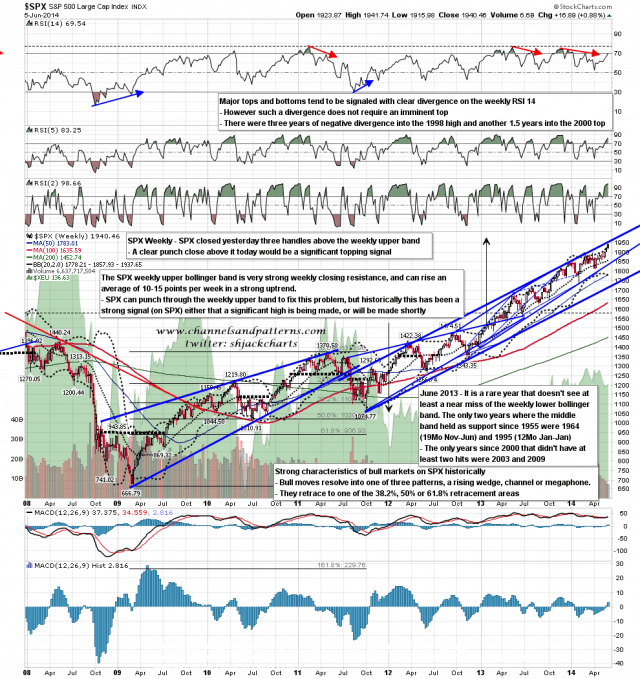

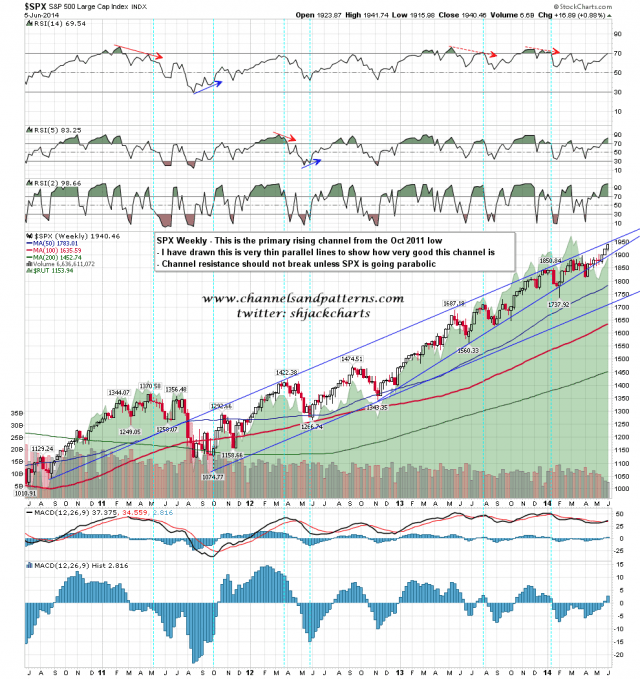

SPX is running into significant bollinger band resistance here however. The close yesterday was three points over the weekly upper bollinger band and if there is a close today with a visible punch over the weekly upper band (say 7 points or more above), then that is a rare event and a strong signal that a substantial retracement is close. SPX weekly chart:

So what are the technical problems referred to in the title? This just looks like a bull breakout that could take equities another leg higher. Well I was referring to a possible bull flag on RUT earlier this week as dangerous, and that was because though the 1190 target looked reasonable when I gave it on Wednesday morning last week, RUT had then stalled while NDX and SPX went halfway to target. That meant by the time I noted it that a breakup on RUT to that 1190 target could carry both NDX, and more importantly, SPX through a level should not be breached.

That level is channel resistance on the primary rising channel from the October 2011 low. That is a well formed channel and channels don’t overthrow like wedges. A break up through that channel resistance, currently in the 1950 area, could be a false breakout, though even those are unusual on channels, or it could mean that this bull move from the October 2011 is entering a parabolic bubble phase, which seems unlikely for a number of reasons, would need to be considered seriously if that channel were to break with confidence. SPX weekly chart -primary channel:

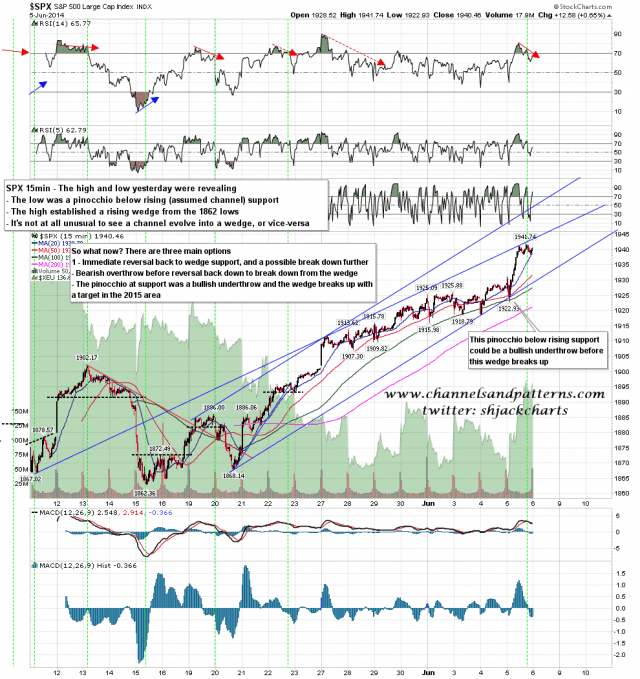

So what does the short term SPX chart tell us here? Well I posted the rising channel from the 1862 lows a couple of days ago and both the high and the low yesterday shed light on the setup here. The low yesterday made a pinocchio through the rising support trendline. This is something that is more common on a wedge than a channel. The high established a rising wedge within the rising channel. That’s not unusual as channels often evolve into wedges and vice-versa. SPX 15min chart

With this setup there are three main options here which are:

1. Immediate reversal back down to wedge support and a possible break downwards

2. Bearish overthrow before reversal back down to most likely break down from the rising wedge

3. The pinocchio at rising support was a bullish underthrow and the wedge breaks up with a target in the 2030 area.

Something is going to have to give here. Either NDX and RUT are going to fail to make their targets and reverse back down very shortly, or SPX is likely to make a very rare and frankly disturbing break over primary rising channel resistance that could be a false break, but might well otherwise start a parabolic move up on equities towards a destination that would be hard to guess, though I’d mention in passing here that I do have an open long term pattern target in the 2450 SPX area.

The chart to watch here to see which way this will go is the SPX 15min chart setup. That is obviously leaning strongly towards a significant high under 1950, but on a conviction break above would target the 2130 area, a target which would at that stage be supported by the larger rising wedge cum channel setup from the 1737 low. I’m leaning towards a downside resolution but the signals are now mixed, and I’m wondering whether the very strong channel resistance in the 1950 area might be broken. If it is then we may not see a decent summer retracement this year.

I’ll be posting updated TLT and AAPL charts on twitter as I’ve used my chart limit today on equity index charts. Everyone have a great weekend. 🙂