Regular readers have probably divined that I don’t have mountainous amounts of respect for authority figures. I tend to live on the right side of the law, so civil “servants’ have never done me any good. My relationship with the government consists mainly of giving them taxes in exchange for – – ostensibly – – living in society. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Cupid and Psycho

I don’t think any post I’ve written caused as big a kerfuffle as A Change In Tone, which was just a  week ago, in the aftermath of the Yellen bear massacre. So now that so much time has passed, I thought I’d reflect a bit on where things stand and my present disposition.

week ago, in the aftermath of the Yellen bear massacre. So now that so much time has passed, I thought I’d reflect a bit on where things stand and my present disposition.

At the moment, I am:

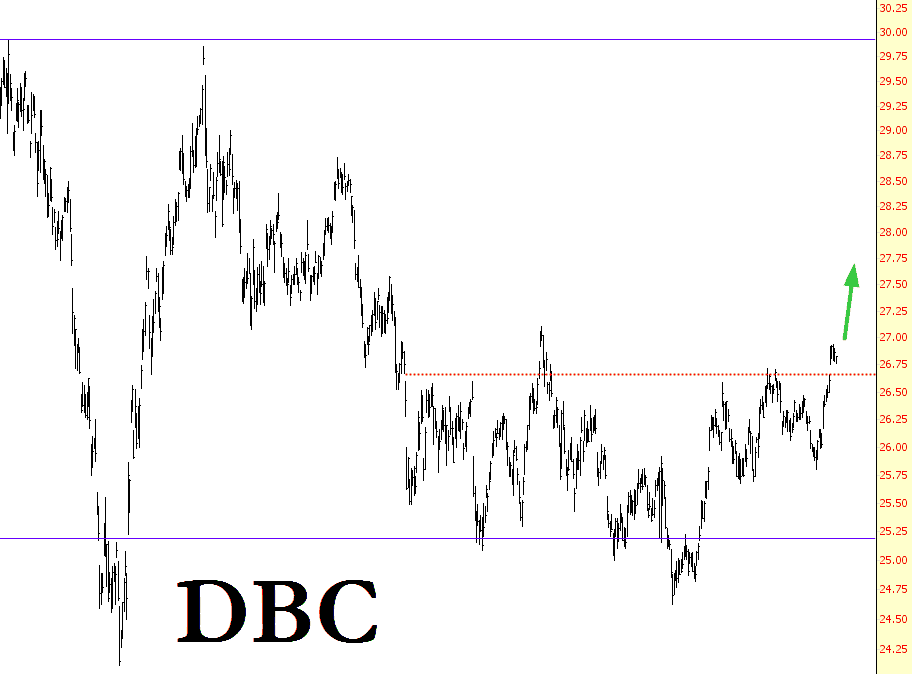

- Bullish on commodities (examples: DBC, USO)

- Bullish on precious metals (examples: GDX, GLD, SLV, GDXJ)

- Bearish (yeah, still………) on most stocks

- Cautiously bullish on a handful of carefully-selected stocks (example: WPZ)

It continues to be maddening – – absolutely maddening – – that honest-to-God bad economic keeps rolling in, yet the market keeps shrugging and marching higher (freakishly, yesterday’s welcome drop was pretty much out of nowhere and for no particular reason).

I will say, however, that taking a more balanced approach to the various choices in front of me has left me a lot less anxious, less dogmatic, and less hung up on seeing Janet dangling from a branch somewhere. Don’t get me wrong – – I’m still leaning heavily toward equities taking a meaningful hit (although a true bear market is, sadly, probably going to take much longer than we think to really take hold) but there are indeed some markets in which I can be enthusiastically long.

Swing Trading Watch-List: BHP, ITUB, JNPR, STX, BBD

Hopping Aboard the Inflation Express

My “balanced” Slope of Hope continues with another bullish idea – commodities. That is, symbol DBC, shown below, which I am long. In spite of what your government is telling you, inflation is heating up, and as the central banks of the world force their servants/masters (the big banks themselves) into spewing ever-more cash into the economy, you’re going to see this launch like a rocket.

A Road to 1884

SPX made my target area at 1965-70 and rejected hard there. A candidate significant high for a 10%+ correction is in place but we’re going to need to see some follow through here first to open up the obvious downside targets for that correction. On the SPX 60min chart the 50 hour MA was broken near the close yesterday and SPX closed below it. I’d like to see that established as resistance today and after that any significant break back above it would be a warning that this retracement might be over. (more…)