Well, I might as well succumb to World Cup Fever, which has affected even Slopers. Hence, the subject line for this post. Anyway, I just wanted to share a few thoughts on a handful of charts before calling it a day.

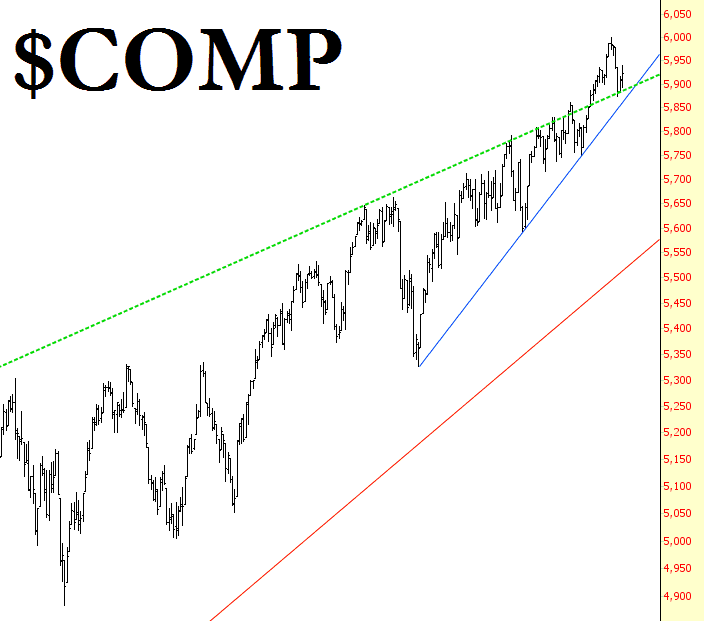

First, the Dow Jones Composite pretty much tells the story – – – last week’s dip was simply “the pause that refreshes”, and since it failed to break the supporting trendline (the dotted green one), we are still in the same Bull Mode that we’ve been in since John Kennedy was in office and color televisions in every home was just a distant dream.