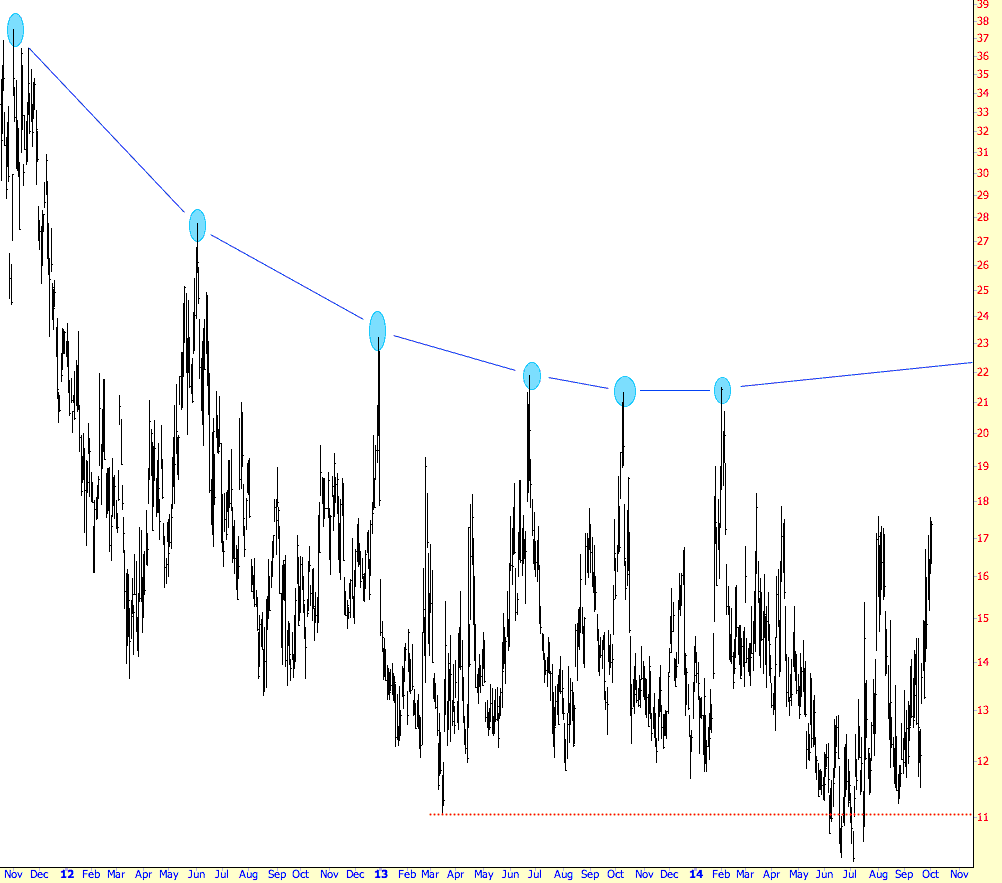

My posts are going to be a bit odd over the next few days, as I am traveling (which explains the market’s weakness – – – you’re welcome). As I’ve said over and over again, I’m holding strong to my gazillion shorts until we get to about 22 on the VIX. I am utterly hung up on that number, since it allows me to hold on tight during the insane “up” days that we get from time to time. There are plenty of stocks right now which are very oversold, but frankly, what I’ve been regretting the most lately is covering shorts that looked oversold and went on to be really, really, really oversold. So I’ve been leaving lots of cash on the table, since some of these stocks have firm support at $0.00. I’m trying to show more testicular fortitude on my myriad other holdings. (Side note: many thanks to the folks that kicked over a donation for my hard work; I assure you, it is much appreciated).

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Cards on the Table

I was saying on my daily SPX chart yesterday that if we were going to see a move directly to the double top target at 1937.70, then I was expecting that move to start yesterday, and obviously that’s what we saw. The low yesterday was at 1941.7, and we may well make that full double top target today.

This move was an important point of recognition and I think it is likely now that the market is starting a 10% or more correction, though we haven’t yet had the full confirmation of that move that would come with a conviction break below the 1904 low on SPX. That 1904 level is the support level on a large double top that would target the 1789 area on a break below 1904, and that 1789 level is very close to both the 23.6% retracement level for the move up from October 2011, and rising support from that same low. (more…)