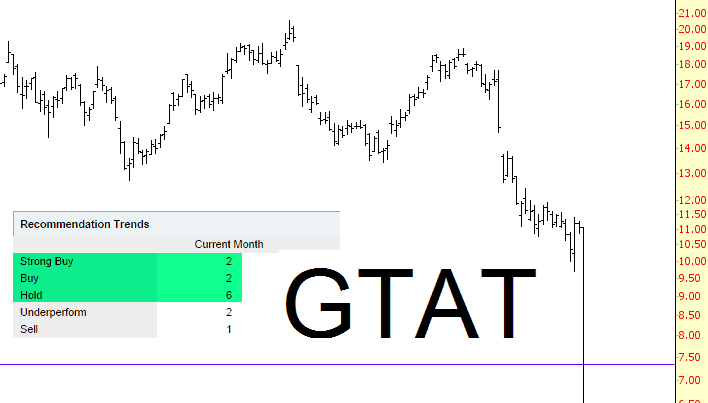

Wall Street Analysts, surely some of the most overpaid souls on the planet (with the exception of Palo Alto firefighters……….) once again prove their utter worthlessness by way of GT Advanced Technologies, which this fine morning is quoted down 85% due to declaring bankruptcy (which tends to have a deleterious effect on security prices). You will note that in this entire swarm of analysts, only one of them bothered to have a Sell rating (versus the ten who thought buying GTAT was a swell idea). The chart doesn’t reflect today’s price drop, since I don’t want to put up a two-foot high post.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

So Here We Are Then

It has been a great run long and short over the last few weeks, and within reasonable tolerances, I’ve called every turn on SPX since I went on holiday in mid-June. Does this mean that what I am expecting to happen here must happen? No, it doesn’t work like that. As I was saying on Friday, the downside scenario is the higher probability path here, and I’m giving 75% odds of a bearish resolution here. That means that I am giving the bulls 25% odds of breaking up to new highs on SPX, and of collapsing the bear scenario that I have been following as it has formed over the last few months. 25% is not a small percentage and it could very much happen. No-one should mortgage the family farm to go short here.

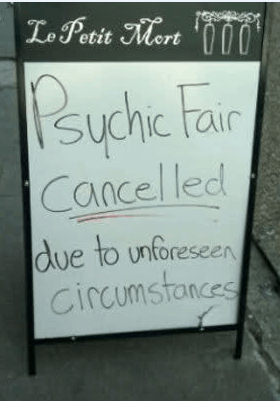

I call the market very well, but no-one can know the future. Anyone who says they do is either deluding themselves, or trying to delude others, or both. Always consider the possibility that any trade can go the other way, and have a plan for that too: