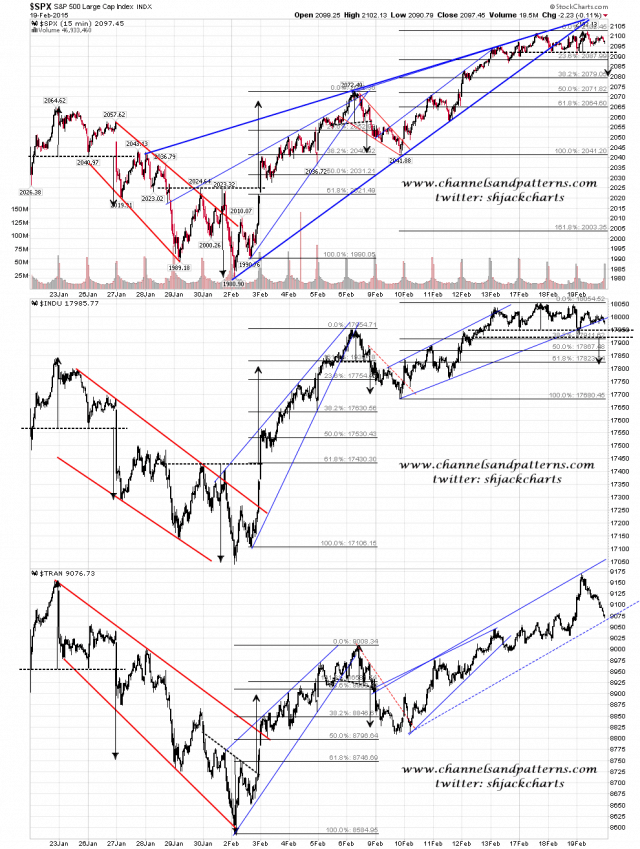

I’ve had a few questions about whether I think that the uptrend from 1980.90 is over and on balance the answer is no. The reason why is on the charts below showing the patterns from that low on SPX, Dow, TRAN, NDX, RUT and NYA. Only two of those show decent patterns from that low and they are SPX and RUT. I could be mistaken but I’d be expecting most or all to show decent patterns at a strong high. If we see a break back down through the daily middle band at 2056 I’d look again.

Screen 3x SPX INDU TRAN 15min chart:

originator of ideas, thoughts and analysis that while not all my cup of tea, is interesting enough that it is linked at

originator of ideas, thoughts and analysis that while not all my cup of tea, is interesting enough that it is linked at