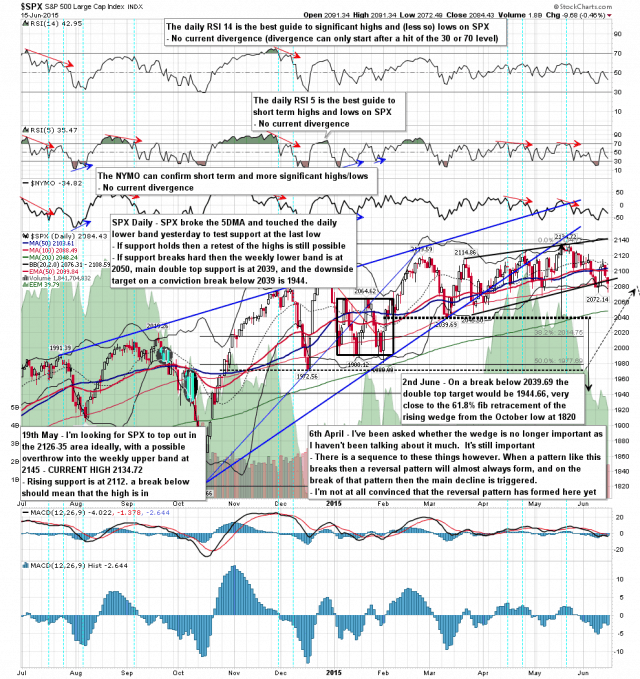

I’ve been leaning towards a retest of the highs in recent days, and the main reason for that is the falling megaphone from the all time high which broke up slightly at the high last week. Since then though SPX has lost the support at the 50 day MA & EMA, and then the 50 hour MA, and followed up by losing support at the 5 DMA yesterday. From here there are two obvious paths forward:

On the bull scenario a double bottom is forming that would target 2103.5 on a break over 2088. Once that played out bulls could have another try at the daily middle band to try and open up a possible retest of the high which would be supported by the falling megaphone that would then be targeting a retest of the all time high.

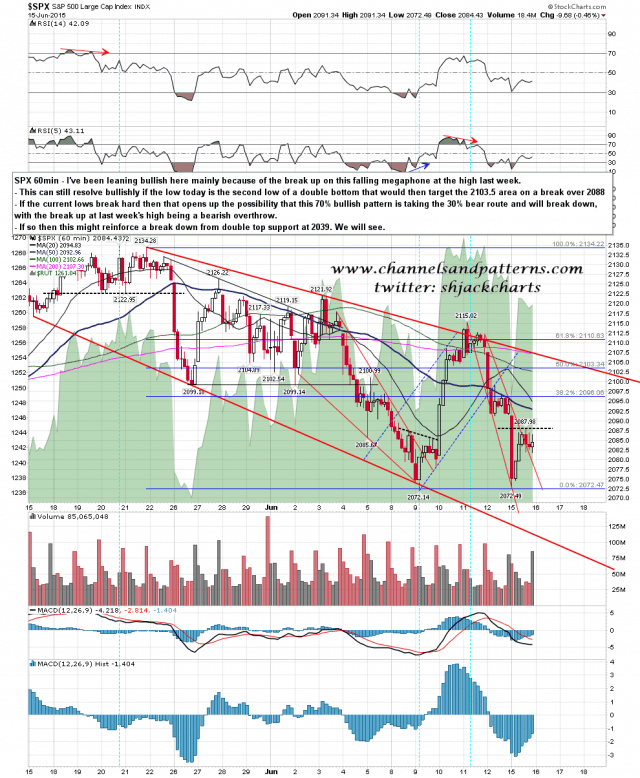

On the bear scenario support in the 2072 area breaks and SPX is on a second lower band ride down. There is some support at the weekly lower band at 2050, then at main double top support at 2039, and then on a conviction break below 2039 the double top target would be in the 1944 area, just above the 61.8% fib retrace of the rising wedge from the October low at 1940. On that conviction break below 2039 the falling megaphone from the high would most likely also break down, making the break up last week a bearish overthrow, and strongly supporting the double top target at 1944. SPX 60min chart:

SPX daily chart:

I still like the pattern setup for a retest of the highs from here but the bulls haven’t been delivering in recent days. If they lose support in the 2072 area then bulls may get another chance to regain control in the 2039-50 area, but the case for a highs retest will by then be a lot weaker. The timing wouldn’t be great either as the historical stats for Monday through Thursday next week are all bearish.