Gold has been in a general downtrend for nearly six years now. There have been spurts here and there, of course, and those who play the leveraged instruments (DUST, JDST, etc.) in the right direction have been able to make fortunes (or get ground into hamburger). Let’s take a quick look at a few SlopeCharts of what’s happening out there.

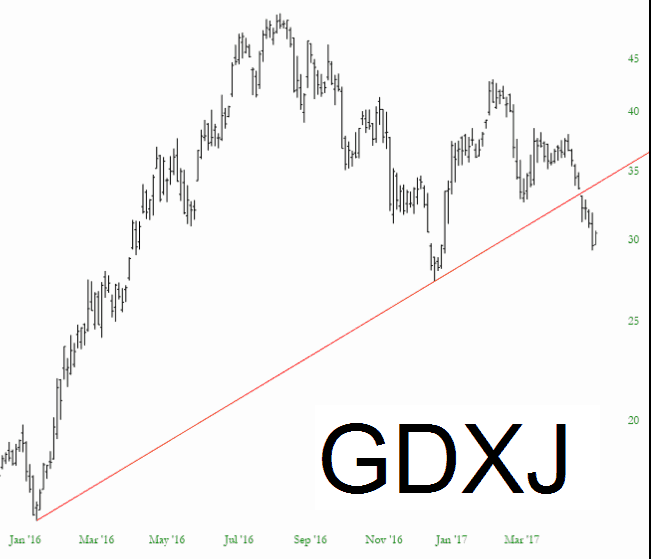

First there is the junior miners. Short-term, this is on the low end of a descending channel, meaning that we could get a bounce higher in the days ahead. Longer-term, however, this trendline break is severe. I don’t think any bounce will get GDXJ any more than a few points.

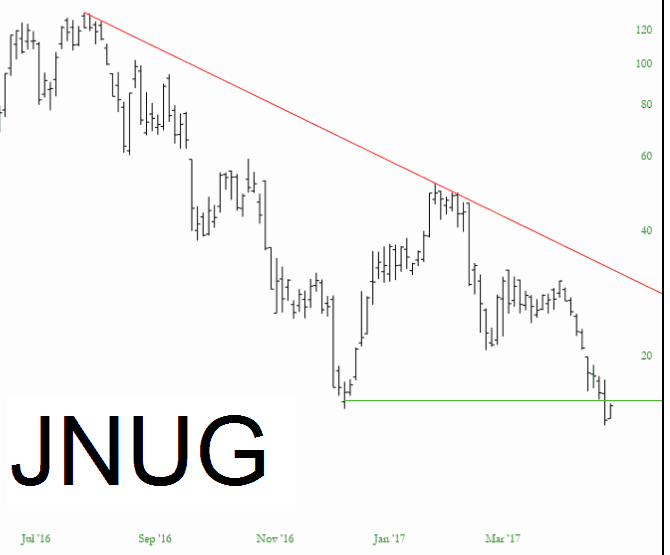

This argument is augmented by looking at the triple-leveraged fund shown below. It has broken its own support level, and it looks like its solid downtrend will simply extend.

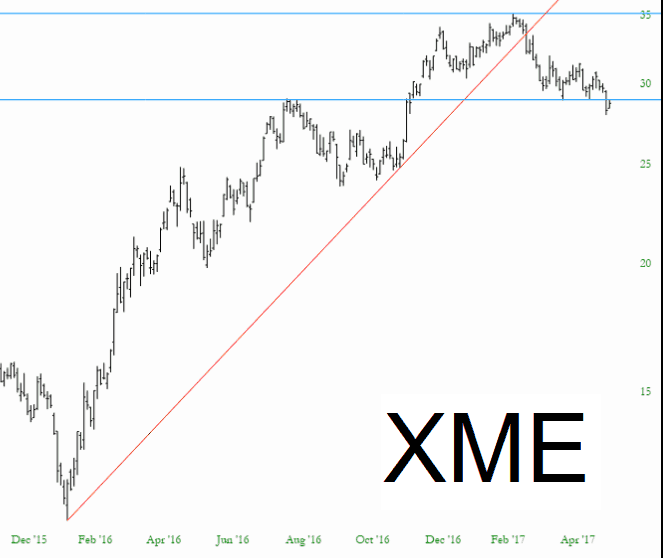

Obliquely related to all of this is the metals & mining fund XME, which isn’t just precious metals. It had been supported earlier by both the red trendline as well as a clean breakout above the blue horizontal, but it’s broken both of these now.

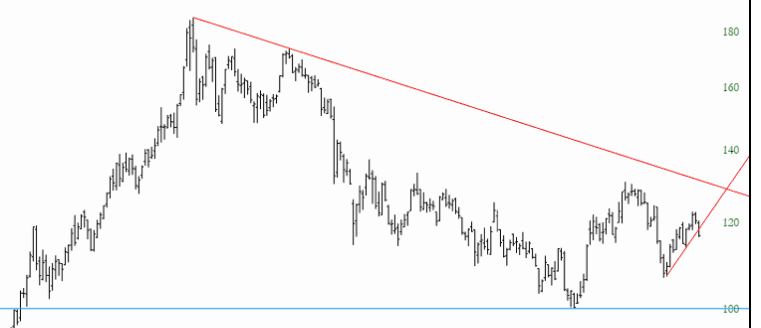

Naturally, the most important chart that’s going to drive any of these is gold itself. In spite of a good showing for the first few months of the year, it seems to have broken its own trendline as well. All in all, I think you’re going to see precious metals (and their miners) continue to trend lower for the foreseeable future.