SPX and NDX both delivered breakaway gaps up on Wednesday that were not filled. Both of the possible bull flags that I was looking at on SPX/ES and NDX/NQ as the lower probability alternate on Wednesday morning broke up, and SPX and ES have made the minimum bull flag targets at the full retests of their all time highs this morning. So what now?

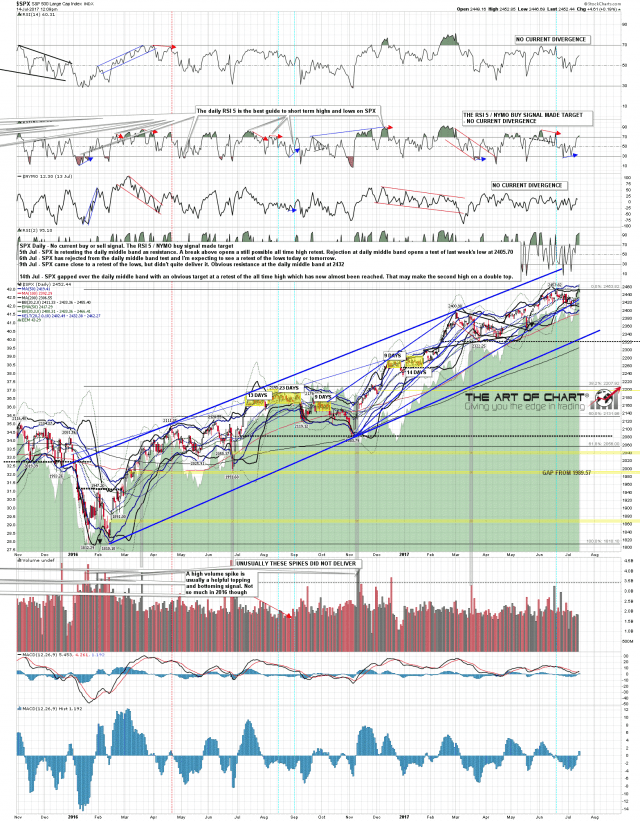

This is a smaller but still significant inflection point here at the marginal new all time high on SPX/ES. The possible SPX daily RSI 5 buy signal that I was looking at on Wednesday morning fixed and has made target, and it’s possible that SPX / ES will make marginal new highs here in the second highs of double tops. If so, ideally, there would be a pullback in this area and then marginal higher highs to set up a daily RSI 5 sell signal on SPX.

This would be that headfake possibility that I mentioned on Wednesday’s post if we were to see a break up on Wednesday. That would generally involve a touch of the daily upper band, touched at the AM high today, and then a rejection there that would not need to be seen today back into the lower band. SPX daily chart:

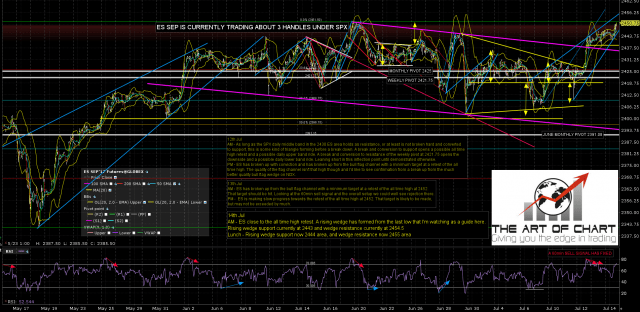

There is support for this scenario on ES, with a decent quality rising wedge forming from the low this week, and since I capped this chart rising wedge resistance has been tested. Watching to see what happens here, but I’d note that ES is already on a 60min sell signal. ES Sep 60min chart:

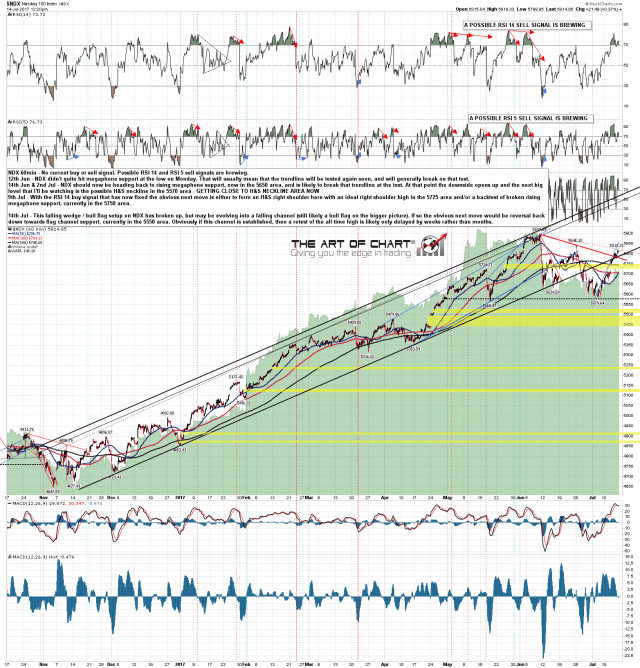

The NDX bull flag has also broken up with a minimum target at a retest of the all time high of course, and the key question here is whether NDX is going to need to make that target. I’m considering an alternate scenario where the falling wedge flag evolves into a falling channel (also likely bull flag). If seen that would likely only defer that all time high retest or weeks rather than months though. There is a lot of hourly negative divergence on NDX here with both RSI 14 and RSI 5 sell signals brewing there. NDX 60min chart:

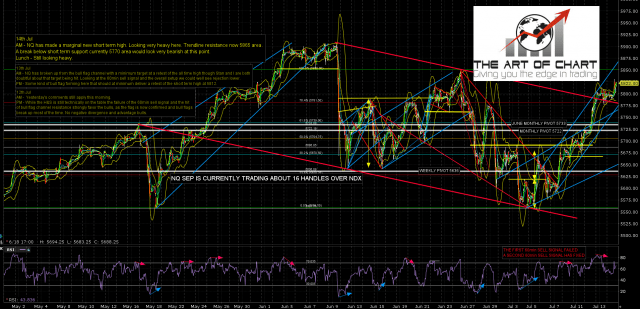

There is also already a 60min sell signal fixed on the NQ chart, suggesting that a retracement at least is close, even if the all time high retest follows that soon after. NQ Sep 60min chart:

Looking at our Big Five charts in the webinar at theartofchart.net last night we were both doubtful about an all time high retest on NDX here short term, but maybe. Time, and price of course, will tell. If you missed last night’s webinar then you can see the recording posted on our July Free Webinars page. Everyone have a great weekend 🙂