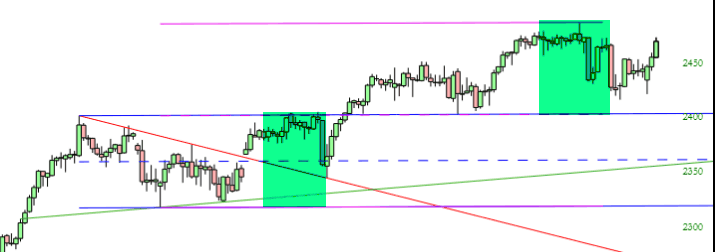

Friday morning’s jobs report is a fairly important news event – – – one on the calendar, at least, as opposed to these (ultimately meaningless) missile attack threats from the lunatics in North Korea. I’ll be watching the ES most carefully. It has been in a range for a while, and after it broke out, its ultimate peak was precisely the measured move (see green tints). Suffice it to say, it would be mad for me if we pushed to new lifetime highs.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

EZ Disaster Guide Part Two

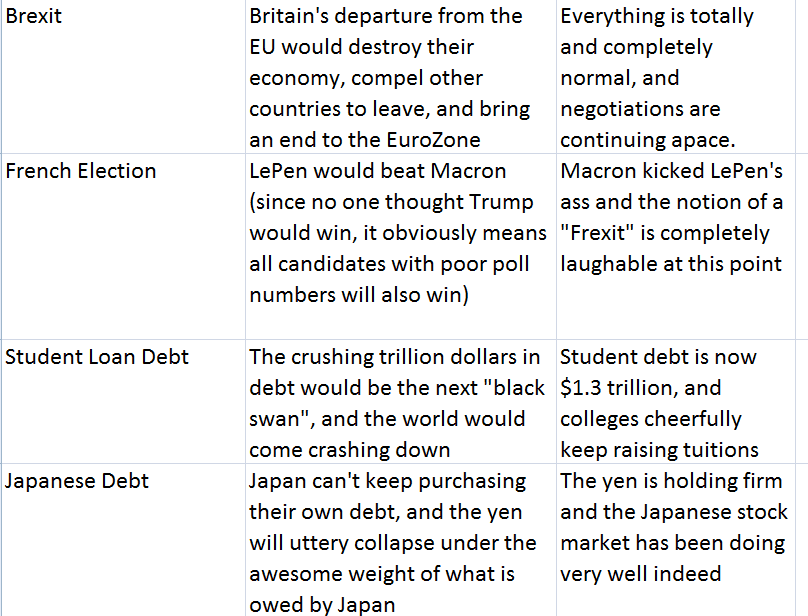

There were many comments for my EZ Disaster Guide post yesterday, in which I recounted some of the principal disaster scenarios offered up by a certain blog (which, again, I like very much) but never materialize. Slope’s own Mr. Wizard reminded me of some other “failed failures”, and I’d like to share them here in my own words, with thanks to Wiz:

Swing Trade WTW DIS AAOI

Behold the Rulers

I have a watchlist in SlopeCharts of 140 symbols that I called PermaRisers. These are stocks which basically seem to go up pretty much forever, irrespective of…………anything. It makes me wonder why there’s an entire industry of financial professionals and advisors (to say nothing of financial bloggers like myself) when it seems everyone could just dump everything into securities like those shown below (click on any of them for a bigger picture and to see what the symbol and company name are). Simply stated, you could put a ruler on the screen diagonally, and the price would never dip beneath it.

August, Die She Must

The autumn winds blow chilly and cold.

September, I remember…….

A love once new has now grown old.

At this point, I think if North Korea announced an imminent attack, the market wouldn’t even bother going down temporarily. It would simply commence its post-missile buying, since, after two times now, it probably wouldn’t want to bother with a five-hour selloff.

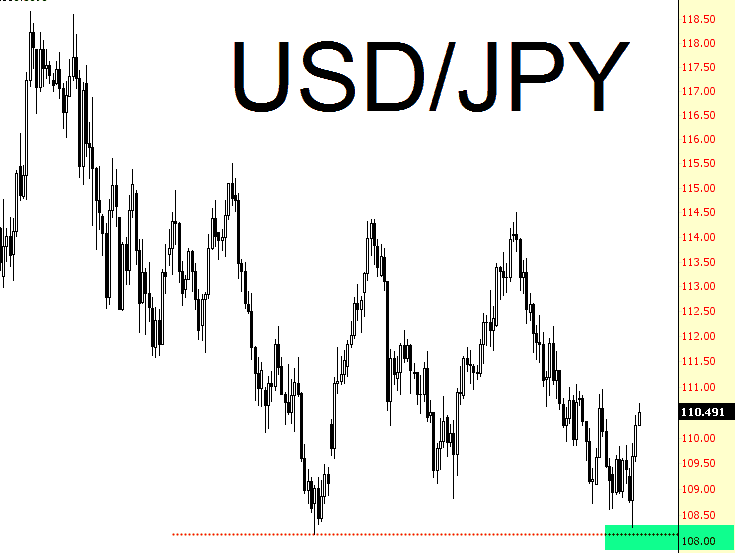

But the third time isn’t here yet; we’re still bouncing higher from the second. We got aggravating close to some serious selling, but the Japanese Yen saved the day. As you can see in the cross-rate below, the US dollar was about to break important support, but boing, it recovered. Until we break 108, things aren’t going to change.