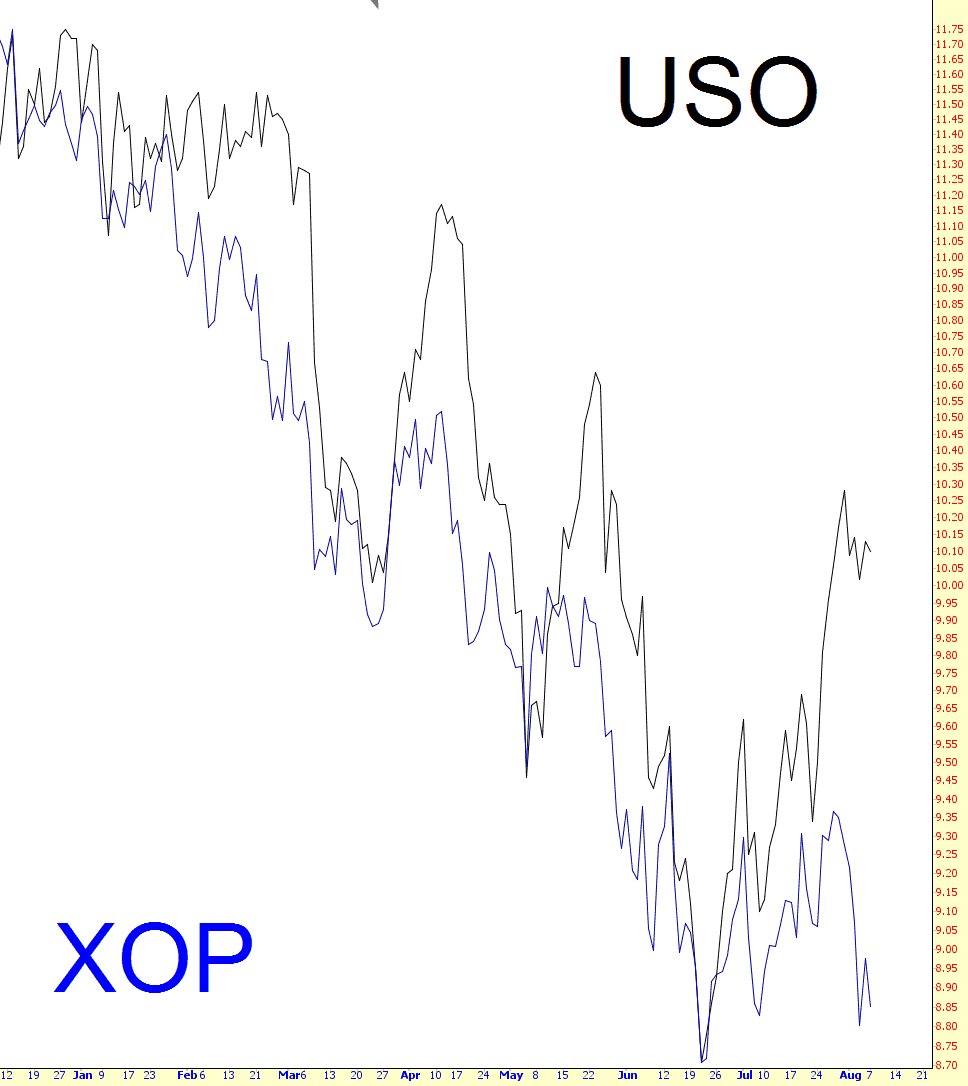

I’ve maintained a steady interest in energy issues, and I’ve been noticing with increasing delight that energy stocks are acting weaker than oil. On days that oil is strong, energy stocks are either “meh” or, in some cases, down. On days that oil is weak, energy stocks are really weak. You can see the increasing spread here:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Great Interview – Watch!

Swing Trade CAR GOV OI

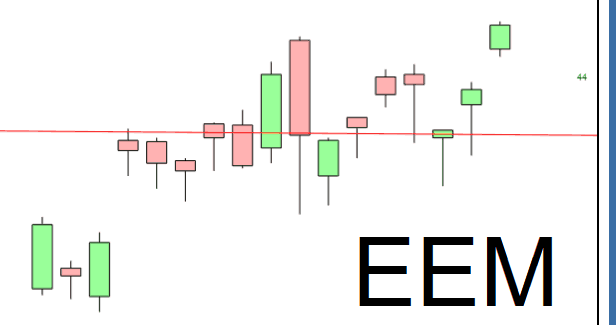

Emerging From Downtrend?

Do you have a blog? No? Count yourself lucky these days. Trying to make this market interesting is like trying to make Janet Yellen physically enticing. It’s damned near impossible. Day after day, the S&P 500 is up a few hundreds of a percent. Weekdays are little different than weekends in terms of market volatility, which is hovering around nil.

Yet the show must go on, so here’s something moving a tiny bit – emerging markets. It has pushed to new recent highs, which in itself doesn’t seem that interesting…..