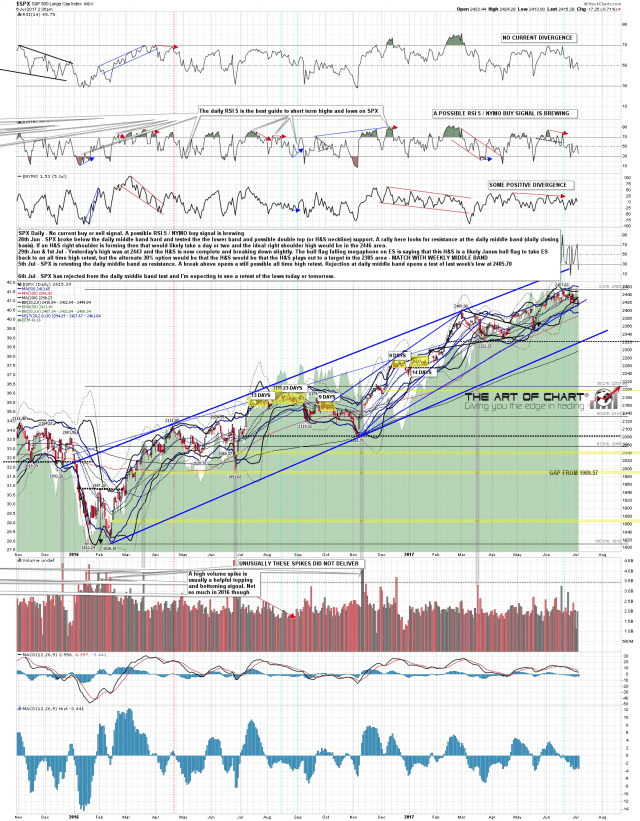

SPX rejected from the backtest of the daily middle band yesterday and came close to a retest of last week’s low at the intraday low today. There is a compelling case for seeing that full retest tomorrow as well as a retracement low retest on NQ and that the next important inflection point is there. I’ll be looking at why that is below. SPX daily chart:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Those Putzes on CNBC

In case you missed it during the many instances I mentioned it here and on Twitter, I contracted a virus. Mercifully, it seems to be on the wane (hurray, Tim’s immune system!) but while I was in the throes of my illness, I did something I hardly ever do, which is turn on CNBC (the total amount of television I watch in a year is probably a few hours, at most, and I only vomit my way through CNBC viewing during Fed announcements).

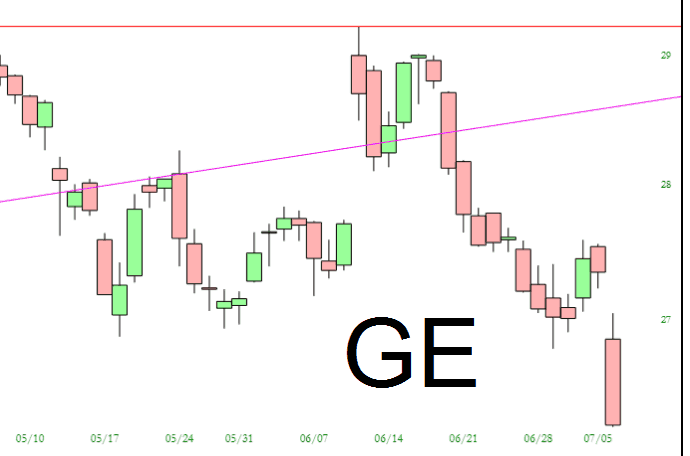

Anyway, the topic of discussion was General Electric (GE), which is my largest non-ETF short position. I took this screenshot earlier today, although I think it fell lower…………

4 Charts for Navigating Murky Markets

At Death’s Door

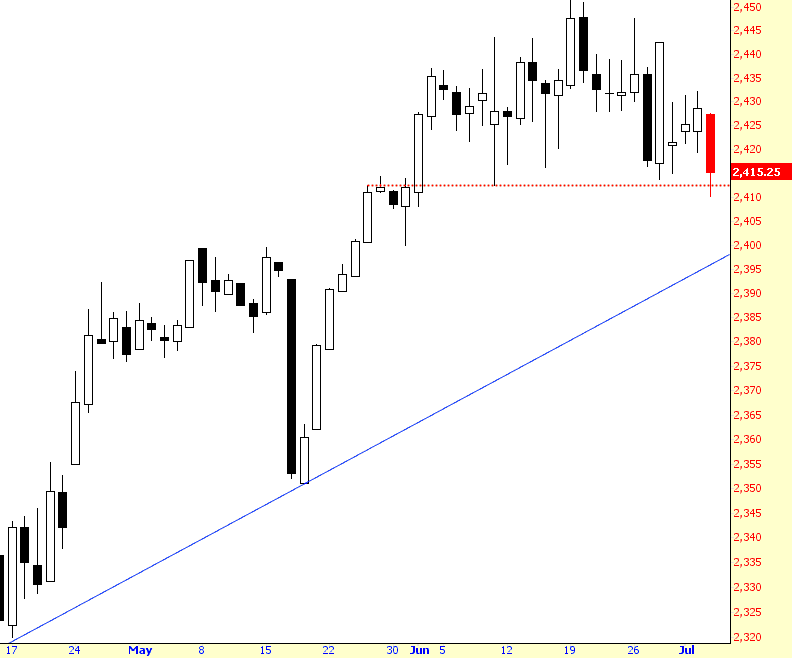

Although the title of this post describes my physical condition, I have crawled over from my bed to put up a post…….what a day for me to be sick, huh? We’re actually DOWN for a change. But I’m ready for them to put me in a coffin. Anyway, if we break 2412.50 and stay below it, those bullish turds are in for some more well-deserved pain.

The Fed and the SPX: Catalyst Fizzle

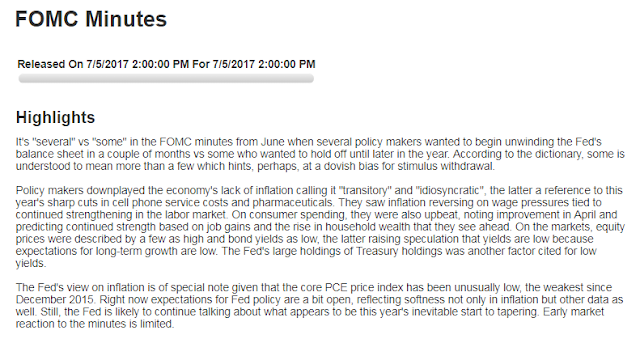

The minutes from the last Fed meeting, released a few minutes ago today and summarized as follows (courtesy of Nasdaq.com), present a mixed view of the economy…