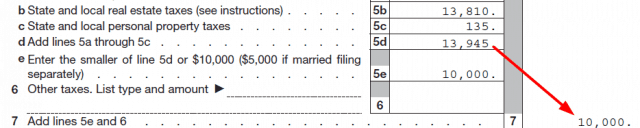

Some of you may recall that a component of last year’s tax reforms was a $10,000 limit on State And Local Taxes (SALT) which includes, important, property taxes on real estate. I had sort of forgotten about this until I begin very crudely roughing out our taxes for 2018 and noticed this:

As you can see, the deduction would formerly have been $13,945, but thanks to the new law, POOF!, about $4,000 is no longer deductible. Those have to be AFTER tax dollars. Keep in mind, I had only calculated property tax on our house: this doesn’t include state and local taxes (which for some folks can be really significant).

That’s a bit of a bummer for me, but for my neighbors who bought their homes later, it will be much, much worse. Let me explain……..

Thanks to Proposition 13, the taxes on our home cannot go up more than 2% per year, irrespective of how much property values have changed. We have owned this property for over a quarter century, so we are effectively paying only 1/7th the taxes we “should” on this property. There’s nothing illegal about not paying the other 6/7ths. It’s just a happy outcome of staying in one place for so long.

But let’s say someone bought a property for, oh, $8 million, meaning their yearly property tax would be something like $90,000 a year. A full $80,000 of that would NOT be tax deductible! Year. After year. After year.

Now I realize that not many people are going to shed tears over some “rich guy” in an $8 million house, but I can assure you, an $8 million house – – while pleasant enough – – would not strike you as anything stunning. It would just seem like…………a nice house.

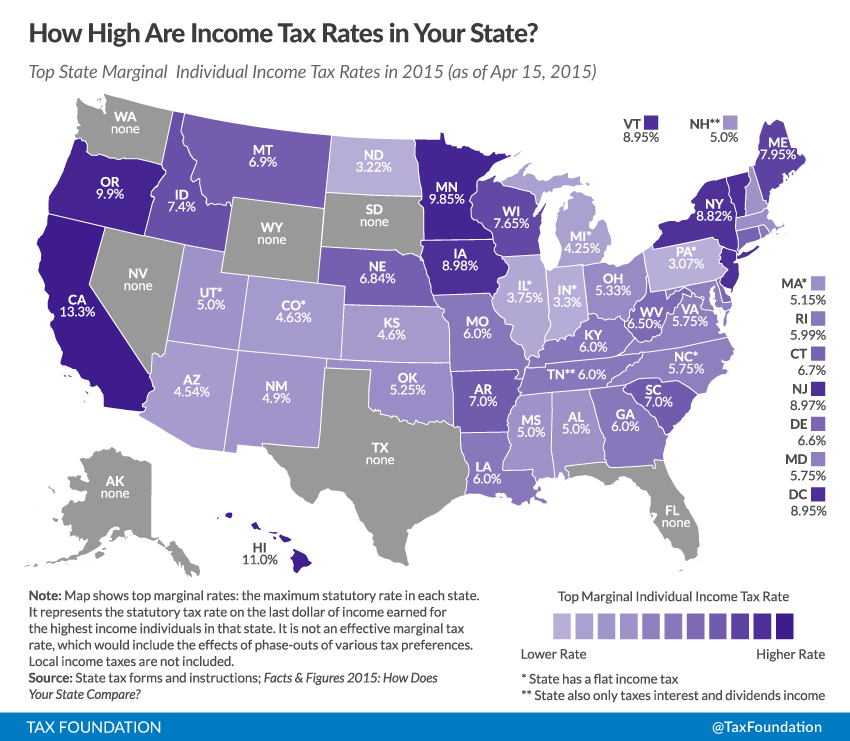

Suffice it to say, people living in areas with (a) expensive real estate who (b) bought within the past 5 years are going to be mighty, mighty pissed to realize just how much of their property tax can’t be deducted anymore, to say nothing of the myriad other state and local taxes that are going to be paid with “after tax” dollars. On the map below, the more purple the state, the more pissed the taxpayers.