Not a week goes by that the Federal Reserve doesn’t introduce some new multi-trillion dollar “emergency” package and shove it down the helpless throats of the public. Ever since 2008, I would wonder “how come this doesn’t seem to bother anyone?” It seem incongruous to me that the citizens of a nation would care so little about money-printing in such astronomical quantities.

Then, duh, I finally realized the answer this morning: it isn’t because John Q. Public doesn’t understand what’s going on (and he doesn’t). Instead, it’s because he doesn’t feel any pain from it. At least not directly. And at least not yet.

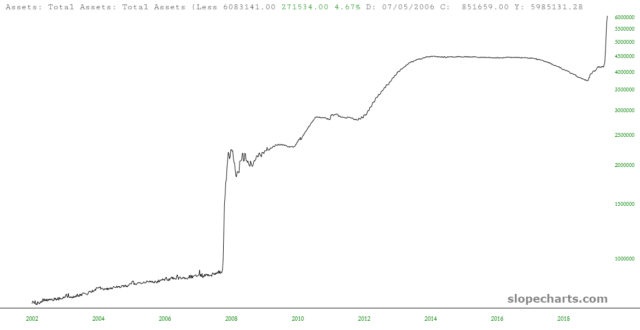

Here is a chart of the Federal Reserve’s balance sheet. There are six general phases, from left to right:

- The very slow, steady, “keep inflation at 2%” accrual before the financial crisis, when the Fed actually had some vague semblance of normalcy and decency (at least relative to today);

- The explosive ramp-up to combat the financial crisis;

- The continuation of asset acquisition, less frenetically than in 2009 but at a vastly sharper pace than before 2008;

- A leveling out, “flat top’ region when the acquisition of new assets stopped;

- A cautious, measured, carefully-planned tapering, ostensibly to get the Fed back to its pre-crisis balance by the year, oh, about 2350;

- Then the latest freak-out, which exploded the balance from $2 trillion to $6 trillion on the way to $10 trillion this year.

Here’s a close-up of those last two parts. There was actually kind of a “stage 5 1/2” in the form of Powell’s Repo program, which brought an end to the pathetic stab at normalization, then things went absolutely vertical in mid-March.

Getting back to John Q. Public: the average citizen doesn’t have Clue One about any of this. He doesn’t know what the Federal Reserve does. He doesn’t know what their assets balance sheet figure is (or what it means). Hell, the average American probably would have difficulty articulating the difference between the debt and the deficit. So a combination of public apathy and ignorance is a winning formula for the Fed, since they can get away with any damned thing they please.

But the real trick is that the public has no way to feel the pain. Let’s just suppose for a moment that the $6 trillion balance sheet was actually drawn evenly from every adult in the United States, as opposed to simply being created out of thin air. There are about 200 million adults (only a portion of them employed, of course, but let’s just include every breathing person 18 years or older).

Take that $6 trillion and divided it by 200 million, and bang, you get $30,000 for every adult. That freshman in college………..that homeless guy sleeping on the sidewalk…………..the private equity manager in his private jet………every one of them.

How do you think the public would react if every single one of them suddenly had a $30,000 charge on their credit card, and they were all required to make payments on it? You think that would go over so well? The pitchforks and torches would finally come out.

Or let’s make it even less extreme. Let’s make it 99% less and just say every single person suddenly had a $300 charge on their credit card from a vendor known as Federal Reserve. That would piss off a lot of folks, wouldn’t it? Because the sting of an actual personal debt that you have to pay off feels a hell of a lot different than some abstract news article about trillions here and trillions there.

Of course, forget all this stuff about the balance sheet; a much larger figure is the U.S. debt itself, which clocks in that nearly $200,000 per taxpayer (and growing by the second):

So to go back to our little credit card allegory, how do you think folks would react to their next Visa statement having a $194,613 charge on it? Yeah, not so well.

The point I’m making is that Powell could declare $900 trillion in “emergency funds for small businesses owned by grandmothers so we’re fulfilling our dual mandate” and all the other deceptive horseshit he trots out every goddamned time he opens his mouth, and people still wouldn’t care. The numbers are too big, and the obligation is far too abstract.

But the moment John Q. Public feels a sting greater than, oh, about fifty bucks or so, he’ll finally start caring. As it is now, though, Powell is every bit the omnipotent financial thug that he was holding himself out to be with Congress only a couple of days ago.

BONUS VIDEO: One of the most hysterically funny things I’ve ever seen: