Between Market Sniper’s death, and the nearly 50% rise in the market over the past month, I’m in a worse-than-melancholic mood. I wanted to share a few thoughts about my own risk disposition.

From late February through late March, I felt like Charles Lindbergh waving to the crowds of Manhattan during a ticker tape parade. From late March until late April, I felt like I was tied to a chair while the ghost of Charles Lindbergh urinated directly into my face. It’s been miserable, even though year-to-date I’m probably ahead of way more than 90% of traders. But still – – Jesus, man, I’ve hated this month.

It doesn’t help that the ES seems absolutely poised to break above its bullish cup with handle pattern.

Worse yet, the small caps – – which is a big focus for me – – already has broken above this bullish pattern.

As I’ve said many times, both joy and pain are, for me, magnified many times, since it isn’t just about dollars and cents. My very livelihood (that is, Slope) depends on the market, and it particularly flourishes during weak markets.

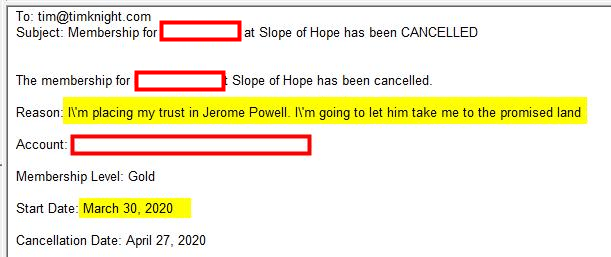

That’s precisely why I didn’t get too excited at the fire-hose of subscriptions I got during the market bottom, because I knew these folks would be the weakest-of-the-weak hands. I think EVERY single cancellation has been from newcomers, including this gem, which I got today:

At this point, I’m ready to take two knitting needles and shove them into Powell’s eyeballs.

I have, since I am not insane, dialed way back on my risk profile. Whereas back in the glory days of mid-March, I was at 240% commitment, I am currently at a puny, pathetic, sad, little 80% commitment with a mere 30 positions. It’s so light that it’s almost embarrassing. But allow me to show you what the equity curve of a person who is absolutely bold, pedal-to-the-metal, and devil-may-care……………….I just fetched this from the boys over at WSB:

So, yeah, I’ve taken some body blows this month, but at least I still have trading capital. There’s a difference between systematic swing trading and compulsive, degenerate gambling.

People sometimes wonder why I have so many positions. As I’ve explained before, it’s strictly Darwinian.

To try to explain – – – I see each of my trading ideas as creatures unto themselves. They have their own shapes, their own form, and their own stop-loss levels.

In friendly environments, they thrive, and I add to their fold. So there might be 50 critters at first, then 70, then 90, then 100. All along the way, I nurture them, tend to them, and wait for the right opportunity for me to extract them. As I whined endlessly in late March, I “harvested” far too early in many cases.

In hostile environments, such as the one we’re in day, many of these critters expire from the heat or the lack of water. A portion of them, God bless ’em, are so stalwart, that they are able to be steadfast in the face of a brutal environment. Those tend to be the exception.

But this is why the herd has been culled to a mere 30 positions. The other 85 – – literally, 85 – – waiting in the wings are perfectly good specimens in their own right, but I would not longer introduce them into this environment than I would put an ice cream sundae on a hot asphalt surface on a mid-July day.

I am going to make a deliberate point of staying my hand for the next 48 hours, partly due to the barrage of earnings, but largely because of the Powell risk. There’s no telling what this madman and his minions are going to do next, although to be quite honest, I think the answer is NOTHING since the heat is absolutely off these guys. So I think his little speech and the softball Q&A session is just going to be a witch’s brew of bromides, platitudes, and aphorisms.

In any event, the last month has been pretty damned miserable, and if the market gods are out there, I sure would like some of that red back. We were all having a ball with it.