For when it comes to trading the financial markets price is the ultimate arbiter of truth. Period. We can whinge and whine all we want about what the market ‘should be doing’ based on a laundry list of technical evidence suggesting that it is ‘overbought’. But in the end, the market will simply do what it wants to do. And when it wants to go up – we aim high – especially during a bull market.

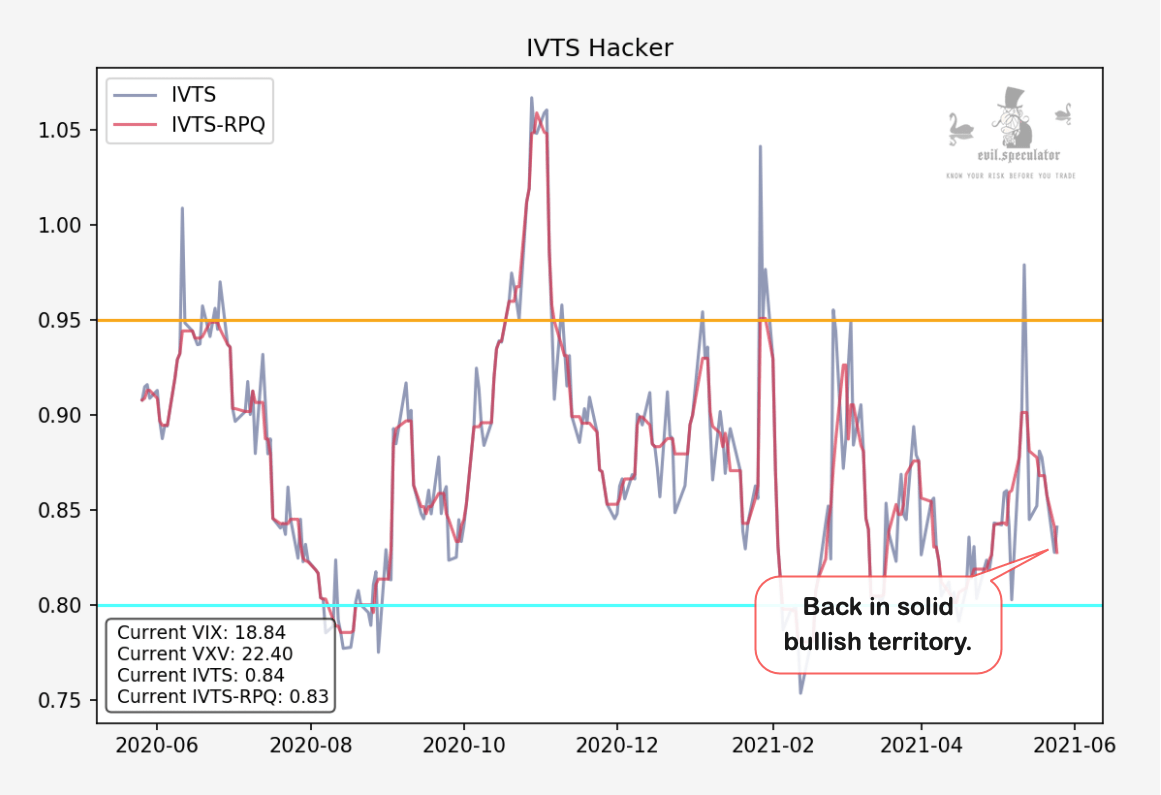

So as you may recall from my previous update I keep seeing quite a few alarm signs flashing hot red, one in particular is excessive SKEW across SPX and SPY options. But then there’s this:

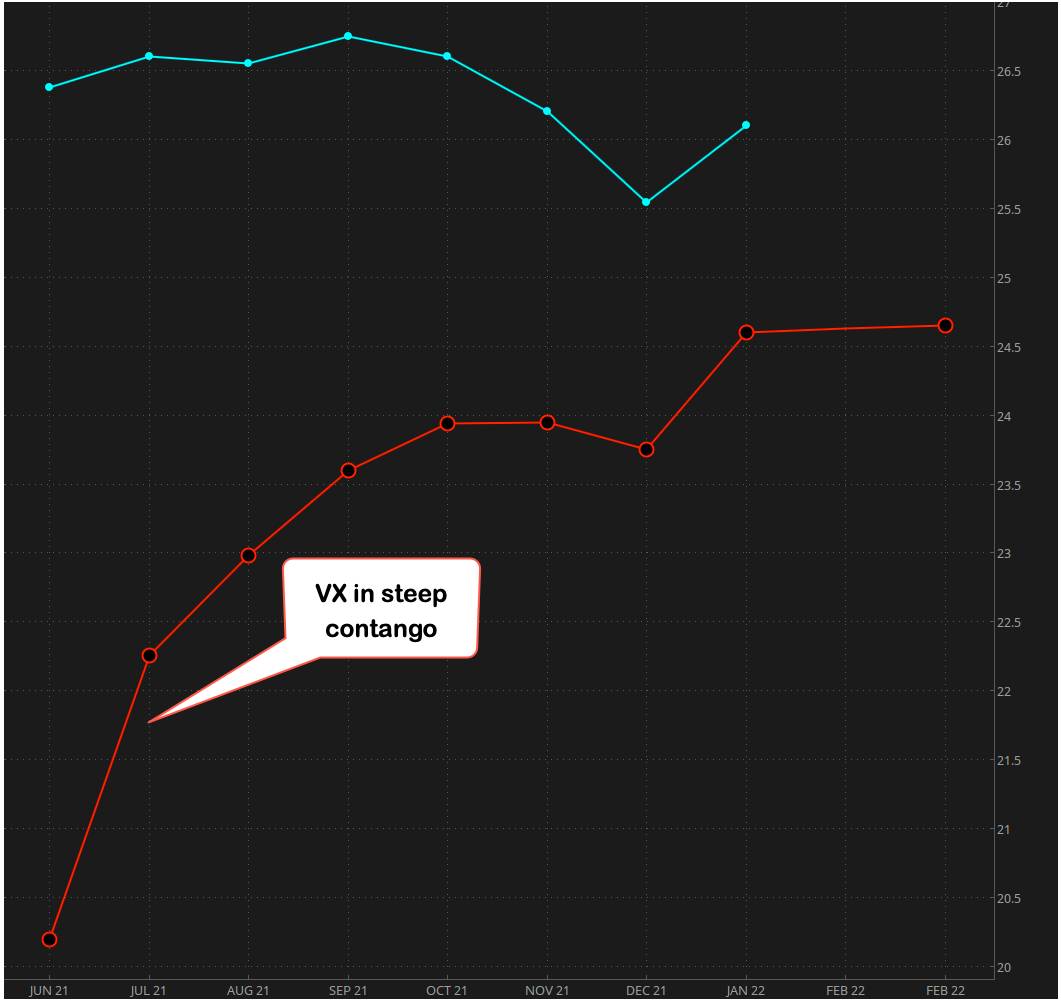

The current VX term structure has dropped into deep contango suggesting that investors are optimistic about the short term and more pessimistic about the medium to long term.

If that outlook looks vaguely familiar to you then you are absolutely right as we have documented this manic/depressive attitude for well over six months now.

Everyone continues to expect the worst in the near term future, just not today. Sign of the times we live in I guess.

Meanwhile the VIX is approaching its falling trend line which began to form almost exactly a year ago and is now well established. I do expect a bit of a bounce or at least a slow down and flattening in IV depletion once we touch the 15 mark.

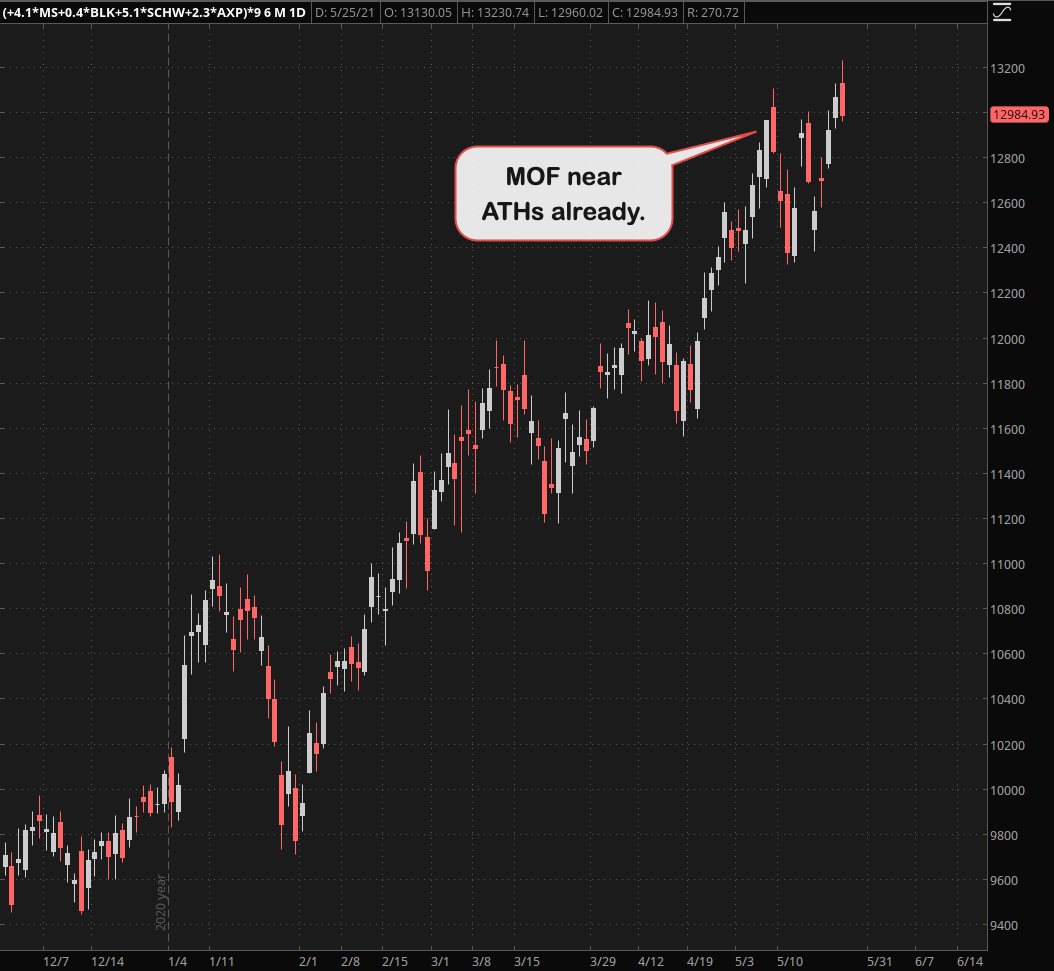

With big tech still lagging behind the one force that continues to drive the advance in equities is finance, and in particular what I call my monsters of finance (MOF) synthetic symbol.

MOFs sounds a bit silly so I suggest we start using MOFOs which has a very nice ring to it 😉

Whatever you may want to call them, I expect this trend to continue. So let’s look at some juicy entry opportunities:

Continue reading this post over on Evil Speculator…