Before I get started I want to encourage all of you interested in trading options to sign-up for my free weekly newsletter. No, I’m not going to send you more than the one email a week and no I’m not running a service. I’m a trader. This is completely free from all marketing. You will find educational topics, research, trade ideas, weekly indicators and more each week. I’ve been on Slope for a long, long time and would love your all of your support. Thanks.

Click the following to sign-up for:

If social media is your thing follow me on:

The foundation of all quantitative or statistically-based options traders rests on one statistical law – The Law of Large Numbers.

The Law of Large Numbers states that as you increase your sample size, in our case number of trades, our expected value or probability of success will come to fruition.

This is because the Central Limit Theorem shows us that actual values will converge on expected values.

But, in order for the Central Limit Theorem to work, we need a large enough sample size or number of observations–in our case, trades. This is where the Law of Large Numbers comes in.

I’m certain many of you during elementary, middle or high school went through the following math exercise.

Coin Toss Example

A coin has a 50% chance, or probability, of landing on heads or tails.

Therefore, according to the Law of Large Numbers, the number of heads in a large number of coin flips should be 50%, which is known as our expected value. Basically, as our number of trades increase over time our expected value, in this case 50% (heads or tails), our win ratio should fall increasingly closer to our expected value—again, 50%.

But we must understand that when we follow a quantitative approach there are several obstacles that we must acknowledge.

Variance is a Factor

When flipping a coin 10 times the variance of the coin landing on heads has an average range of three heads to seven heads. As we increase the number of observations the range tightens until eventually the overall probability of success stands at approximately 50%.

But, early on, due to variance we will experience bouts of sequencing risk.

So, just because our expected value is 50% it doesn’t mean that for every 10 flips we are going to fall right at 50%, or five heads and five tails. In the world of quantitative trading, we call this sequencing risk. Sequencing risk simply means that we could have numbers that vary from zero heads to 10 heads for every 10 flips. We call these statistical outliers, and they should be expected from time to time.

But again, the Law of Large Numbers always falls around the expected outcome as the number of observations (trades) increase.

It’s an incredibly easy concept to understand, yet, most traders simply don’t allow the Law of Large Numbers to work in their favor. Lack of patience is typically the reason.

My Approach to Trading

The Law of Large Numbers is important to understand because unlike a coin flip that has a 50% probability of success, my approach has a probability of success that is significantly higher, roughly 70% to 85%.

As a result, my expected outcome, or win ratio, is going to be 70% to 85%.

This is why professional options traders trade for a long, long time, well after retirement. Stock traders, not so much. Why? Well, again, it comes down to probabilities and when your probabilities are at best roughly 50%…the Law of Large Numbers will eventually catch up to you.

We want the Law of Large Numbers to catch up to our strategies. We want to see our expected probability of success of 70% to 85% come to fruition. Because if we know what are expected outcome is going to be over the long-term we know ahead of time how to manage our risk and managing risk is THE MOST IMPORTANT ASPECT of investing or trading.

A Quick Example Using a Risk-Defined Options Strategy

Every month I place three to five trades using highly-liquid major market and sector ETFs like SPY, QQQ, DIA, IWM and many others.

The following is an example of how I approach my high-probability trading strategy.

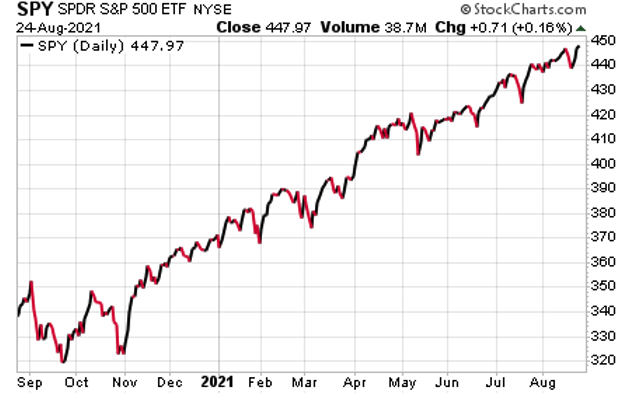

As you can see in the chart below the SPDR S&P 500 ETF (SPY) is trading for 423.22.

I am currently short-term bearish to neutral on the S&P 500.

As a result, I am going to use a bear call or short vertical call spread.

A bear call spread is a risk-defined credit spread strategy that consists of a long and short call, at different strikes within the same expiration cycle.

When using a bear call spread, you have the ability to choose your own probability of success on the trade.

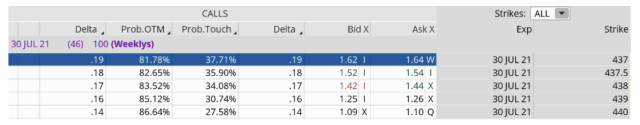

For example, with SPY trading for 423.22, we can simultaneously sell a call at the 437 strike and buy a call, thereby defining our risk, at the 440 strike.

By selling the July 30, 2021 437/440 bear call spread we are able to bring in roughly $0.53, for a potential return of 21.5% over the next 46 days. To calculate the credit received, take the mid-price of the 437 strike ($1.63) and subtract the ask price of the 440 price ($1.10). As always, you may have to alter your price slightly to execute the trade.

The probability of success on the trade is 81.78%.

Basically, as long as the SPY remains below our short strike at expiration we will collect the entire 21.5%. So our margin of error on the trade is just under $14 (short strike of 437 minus the current price of the ETF).

In short, knowing we have a probability of success greater than 80% on the trade, our win ratio, as our number of trades increases, should fall around 80%. That’s right, 80%!

Of course, as I stated before much of your success relies on how disciplined you are as a risk manager, achieved through consistent and strict position-size guidelines. I will cover how I approach risk management in the near future.