When I close out an options position, I don’t simply delete it from my spreadsheet. I move it to a “Closed” section, changing the entry price to whatever price I just sold it. This way, I can see how it does after I’ve disposed of it.

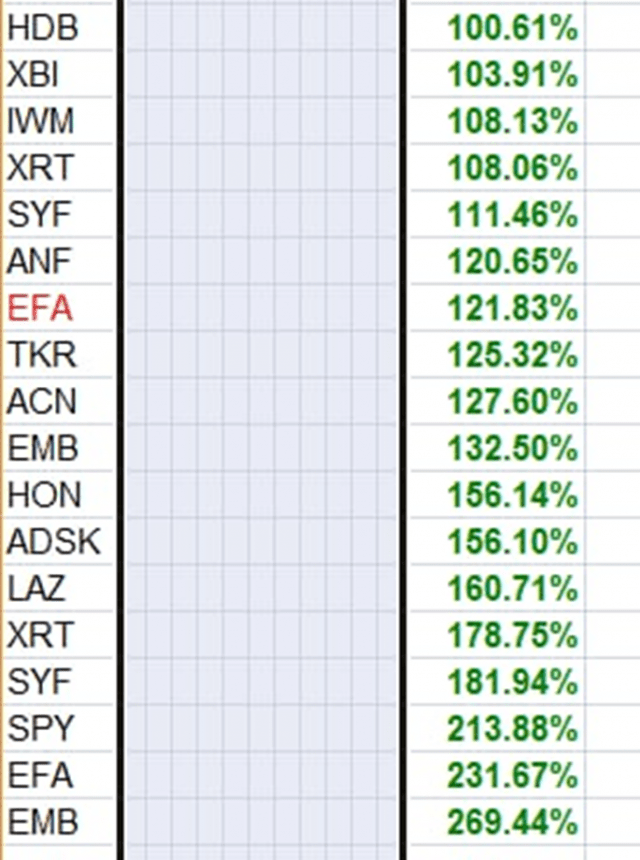

Well, sometimes it is painful to look back. Here are recent triple-digit gainers after I dumped them (sometimes at a loss!) You can see some of the truly terrific charts reflected in these symbols, such as EMB, EFA, and individual stocks. Check ’em out:

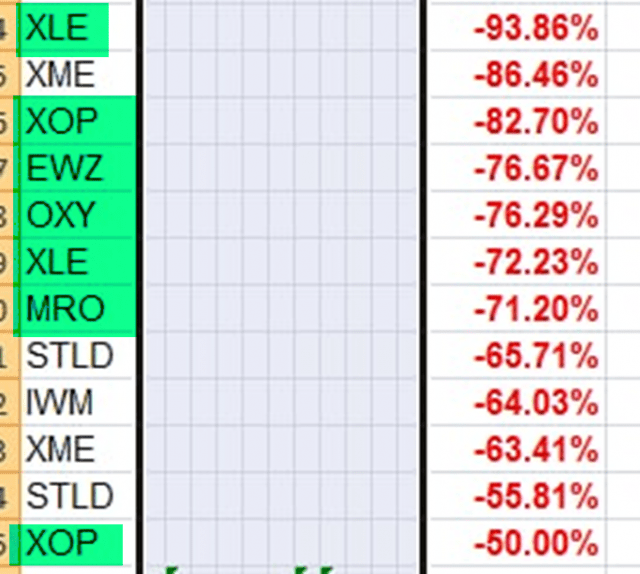

Of course, there are sometimes that getting out of an option is the right move, and not a dumb one. Here are the positions that went on to the worst losses after I sold them. Not surprisingly, many of these were energy-related (which I’ve tinted). In other words, these underlying equities showed strength after I sold them, because all of these positions were put options.

Let’s just say all those big energy moves went right into the profit column of TNRevolution!