Good morning, everyone, and happy new week to you.

The equity futures were red for a while, with the /ES falling about 30 points, but through the wee hours of the morning, that got burned off and the /ES actually even went green. I mean, with absolutely no sign of peace, WW3 being threatened, and Boeing airplanes dropping from the sky once more, what else would you expect?

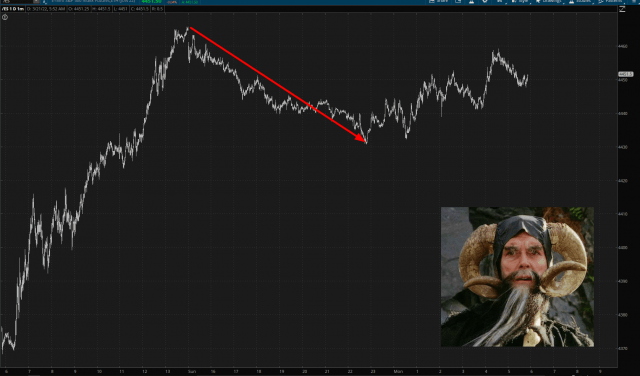

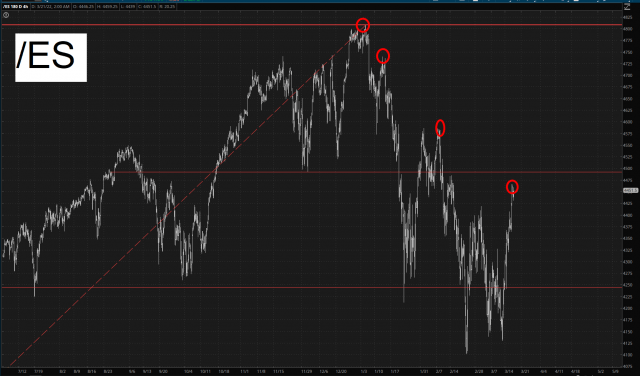

As I’ve mentioned a few times, the 180 degree turn in sentiment has been a sight to behold. In spite of a multi-month shellacking, a four day counter-trend rally has turned everyone (except for me and my buddy Atilla) into raving bulls. I would point out to you, however, the broader trend in the /ES. The market is absolutely trendless, but I think I can safely say that the four-day mega-rally we saw didn’t exactly have the markings of an important bottom.

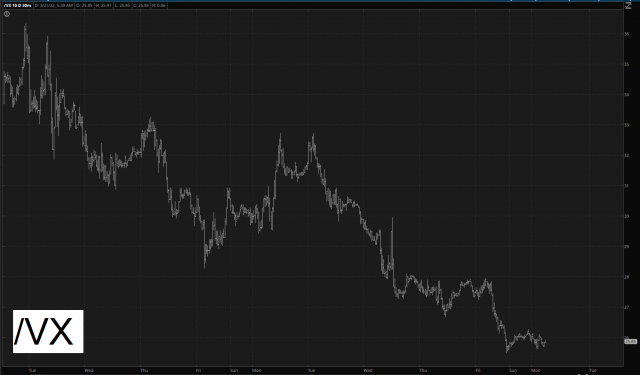

All the same, fear has been squeezed out of the market like Oprah being put through a machine press. Volatility has been cut just about in half, and the trio of words “all time highs” are on the lips of everyone with the gift of speech.

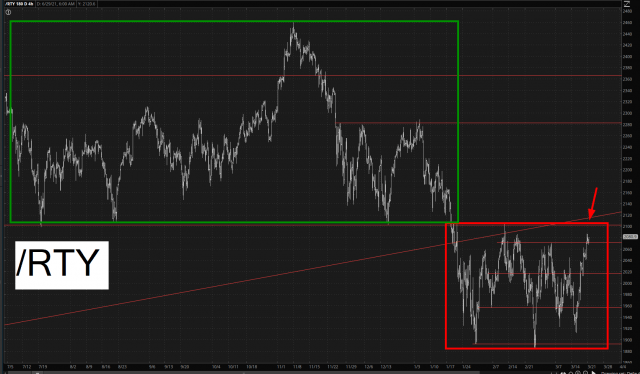

Once again, however, I would ask that you keep things in context. Below is the Russell 2000 futures market which, yes, has been on a mad ascent of late, and as I am typing this, is safely in the green. And yet look at the mountain range of overhead supply (defined by green) coupled with the fact that the multi-week range we’ve been in (red) indicates we’re much closer to the peak than the valley.

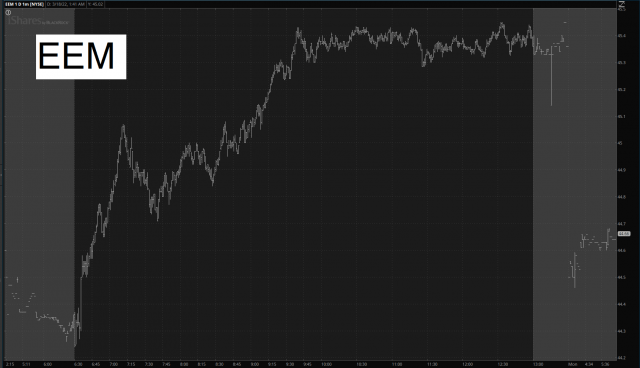

I have, for good reason, garnered a healthy paranoia of our badly-manipulated U.S. markets, so late last week I dedicated my only two big positions to overseas – – that is, Worldwide Equity fund EFA and the Emerging Markets EEM. Here is the minute bar of the emerging markets, including pre-market trading in grey.

The daily chart tells the story. The ideal scenario for this position would be to affirm that failed channel as powerful resistance. We shall soon see!

As I enter into this new trading week, I am rather aggressively positioned on the short side, with 30 separate put positions with an average expiration 111 days in the future. I have 15% cash and, as mentioned, only two large ETF positions.