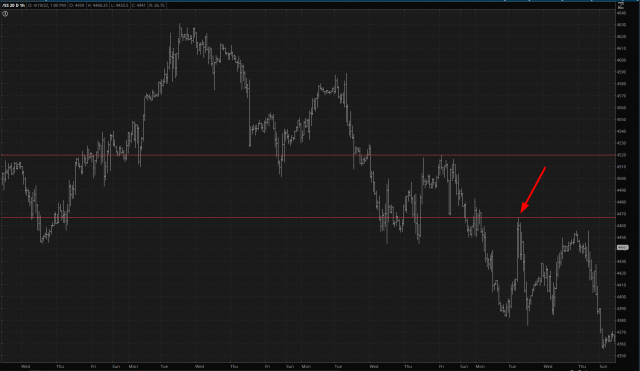

As of yesterday, the markets had spent the month in a steady progression of lower lows and lower highs. The most recent “lower high” to watch is represented here with an arrow.

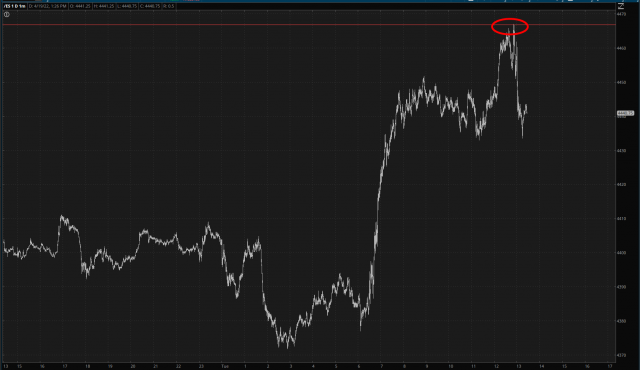

At the absolute peak of Tuesday’s rally, we got a single tick above that level and then did an about-face. Once the NFLX news hit, a portion of the day’s gains were erased.

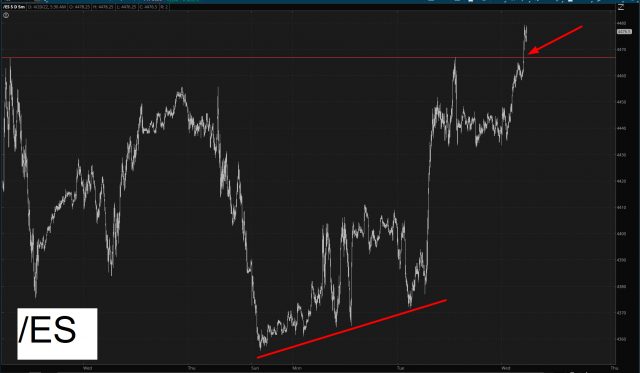

Well, that’s all in the dustbin now, because the entire equity space has erased any concerns about NFLX and is pushing higher. What’s insidious about an up/down/up/down market like we’ve had this year is that, be you a bull or a bear, it’s very easy to get aggressive with your positions at the worst possible time and get out of those positions at likewise the worst possible time. In other words, the cycles coax you (most of you, anyway) into doing the wrong thing in both directions.

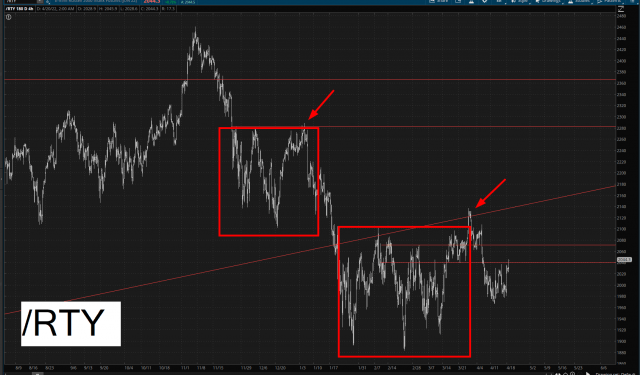

As such, I imagine that any surviving bears will be screaming out of their remaining shorts, and bulls will be piling in aggressively into their longs. Here we see the small caps, by way of the /RTY futures, making a silky-smooth breakout from their own resistance.

I would like to point out, however, regarding the “worst possible time” remark that during the course of 2022, the market has played a siren song during vastly more substantial bullish setups, only to do an about-face. This, in a nutshell, is why 2022 has been collectively maddening for most traders.

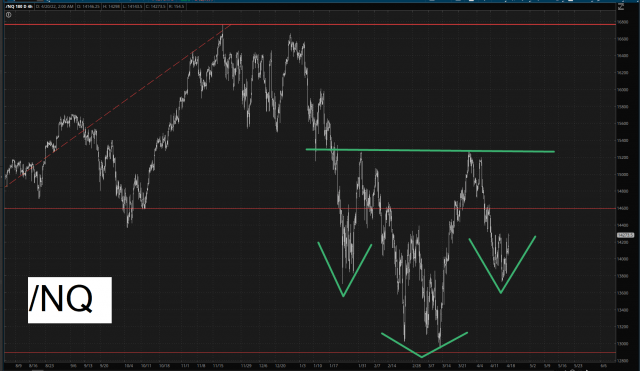

I will say that the most impressive prospective bullish setup is with the /NQ which may be in the throes of a very well-formed inverted H&S pattern. Should it across above that neckline, the bulls could absolutely run with it. Keep in mind that pretty much all the important tech earnings are going to be coming out over the next seven trading days, and then the die will be cast. (Tonight the big boys are the earnings front are Tesla and Lam Research).

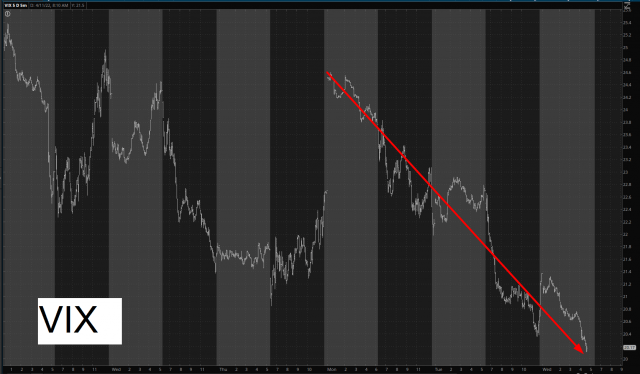

During the course of this bullgasm, volatility has been getting smothered to death in its crib. It seems clear we’re going to be back in the dreaded teens-land, as opposed to the fun and frolic of being in the 30s.

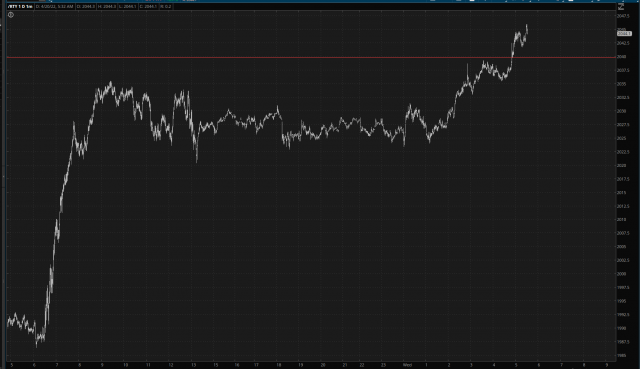

On a much longer-term basis, however, I would say the bulls shouldn’t necessarily get geared up for their 14th consecutive year of unchecked price gains. Below is the Russell 2000 and its trio of exponential moving averages. Once we get away from the tick-by-tick myopia, you can see how the long-term movement is clearly bearish. In fact, even at the highest point of that dreadful March 14-29 rally, it did a picture-perfect job of tagging its slowest moving average before falling once more.

Broadly speaking, though, what’s been exasperating for your host has been the complete insouciance of equities to the bloodbath that’s been taking place in bonds. Below, for example, the symbol LQD illustrates how vicious the collapse has been, even roughly match the point drop of the entire Covid bear market. And yet equities continue to shrug their shoulders, pick their nose, and amble on down the street.

I’ll level with ya, as I always do, and say that I’ve taken 40% of my trading account out (compared to the most aggressive levels from earlier this year) and shoved it into my 0% yielding checking account, and for the portfolio that remains, I still have about 10% cash. In other words, I’m only about half as aggressively positioned as I was earlier this year, when I had more confidence about what was happening with equities. My own cowardice is probably a great contra-indicator about what’s about to happen next.

In closing, I’ve got 20 bearish positions, none of which expire earlier than June 17th, with an average expiration date on the put options of 122 days. My only large position is June puts on IWM, with the other 19 being scattered amongst puny individual equity positions, none of which are ETFs.

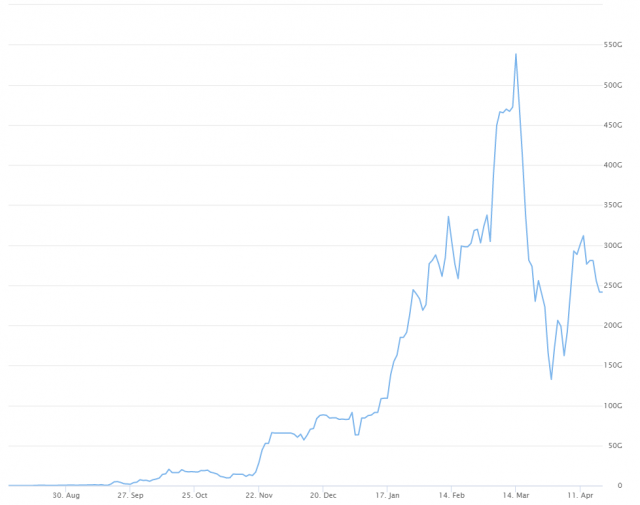

Finally, here’s my virtual account equity curve. At this point, Elizabeth isn’t even returning my calls anymore, and when I do call, Billy picks up and is none too pleased. $300 billion………….gone!