Let’s start off with a simple fact: out of 100,000 people, you’ll find maybe one true bear among them. There’s hardly anyone that’s ever going to posit a bearish argument about the stock market, because they have no vested interest in doing so. Not the carnival barkers on CNBC. Not the equity-pushers from Goldman Sachs, And, God knows, never, ever from any Wall Street analyst. 365 days out of every year, their message is the same: “Buy, Buy, and Buy some more.”

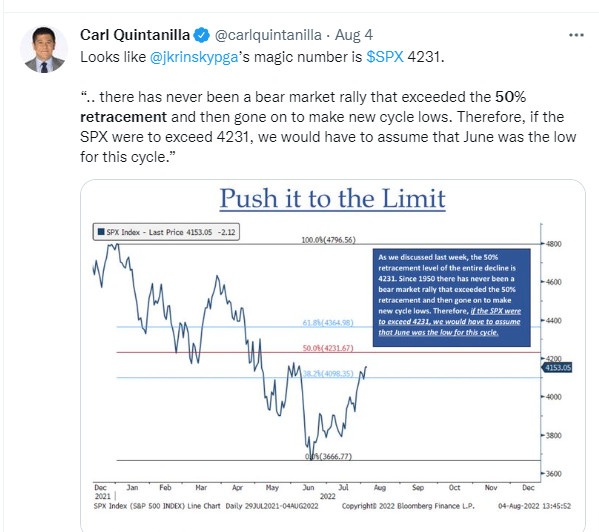

Thus, it is no surprise that we’re seeing a particular “fact‘ being pushed onto the public, stating in no uncertain terms that there has never been an instance in the history of the universe when a market has recovered more than 50% of its price plunge and failed to soar forward into a new bull market. I am seeing this argument absolutely slathered all over Twitter………..

……..and here……….

……..and here………….

I’ll just take a moment and mention, as aside, that there is no such thing as a “50% Fibonacci Retracement”. It’s true that charting programs always have the 50% level packed within the preprogrammed retracement levels (including my own SlopeCharts product), but it isn’t a Fibonacci number. It’s just a nice, clean, round number that humans find appealing.

In any case, there is a ubiquitous notion about the “fact” that we’ve already bested the 50% retracement level, thus it’s party time for the bulls again for as long as the eye can see.

Now, I’ve been doing charting for many decades, and it took me about seven seconds to disprove the aforementioned fact. Allow me to show you a few charts.

Here, for instance, is the NASDAQ 100 early in 2000. It had a tremendous fall, losing about 40% of its entire value (a vastly bigger plunge than we experienced here in the year 2022). Having endured such a brutal bear market, it began to heal and recover, and in short order it had conquered the 50% level not just once, but repeatedly (show in green below). I can guarantee you 100% that the financial media and all the pundits were declaring the Tech Wreck of 2000 to be finally behind, and they could start looking toward new gains.

Below is the same market, but with more time. I’ve left the same tint, and I’ve put an arrow marking the “happy days are here again” point, just so you don’t have to use an electron microscope to see it. Suffice it to say that the Jim Cramers and Tom Lees of the world all looked like vibrators with dead batteries once the NASDAQ had actually finished its total wipeout.

How about a broader market from a different era, just to keep the variety? Here is the Russell 2000 from the year 2007? Here again we have an example of a market which puts the weak-willed snowflake bulls through the proverbial wringer, but, thank heavens, the poor dears saw an end to their suffering as the $RUT emerged from the depths and pushed cleanly above the 50% level.

Once again, the bottom that the likes of the Seth-meister mentioned at the top of this post was, in fact, a long way off.

Let’s finish with a doozy. Here is the S&P 500 from 1929/1930. The stock market had crashed terribly hard, and the government was in a flurry to try to set things right. It’s quite plain to see the bulls were in control again. There was a dramatic capitulation bottom, and then a steady, smooth series of higher highs and higher lows – – the very embodiment of an uptrend. And, glory be, the market pushed into the fabled 50%+ zone, as tinted here with green. Herbert Hoover, I’m quite positive, wouldn’t shut up about how the speculative froth had been blown off the top, and people could finally get back to work again.

Uh-huh.

So I’d like you to keep this all in mind when the likes of Carl Q. (who has about a third of a million loyal Twitter followers) sprays out nonsense such as this.

Yes, as SOME point, all bear markets end, and by definition, it will be at such a time as it has recovered more than 50% of its peak-to-nadir plunge, just as every wildfire has ultimately been extinguished at some point after 50% containment. It’s an utterly circular argument. But until THE BOTTOM is in, whenever that may take place, the percentage measurement of these counter-trend rallies is often misleading. Not only is the Fibonacci 50% retracement not a real thing, but the ability of an equity index to conquer this fictional barrier doesn’t mean dick.