Those of you who use the real estate site zillow.com may know that you can “save” your real estate properties and track them over time. Our family has a number of apartment buildings, but those valuations are hard to pin down and thus not on Zillow. Our homes, however, are, and it’s interesting to see the changes that have taken place recently.

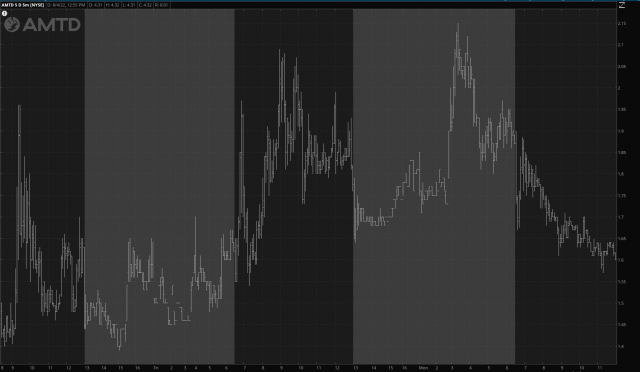

The most dramatic one is in my fair city of Palo Alto. Ostensibly, home sweet home has wildly swung between $6 million and $9 million, even over recent history. I personally find it hard to believe that the swings are anything this crazy, and maybe that’s why Zillow got totally torched with their own real estate portfolio, since the data is kind of spasmodic. Since we’ve lived here for over thirty years, and bought the place dirt cheap, I don’t really care, but those who bought at the top – – God help ’em.

(more…)