After Nvidia released their earnings yesterday, bulls celebrated the world over, and just about everything with a ticker symbol rallied, based on the notion that a niche semiconductor company focused on crypto and gaming was the basIs for the entire economy. Those gains in NVDA are holding fast (happily, the daily chart kept me far away from touching the thing).

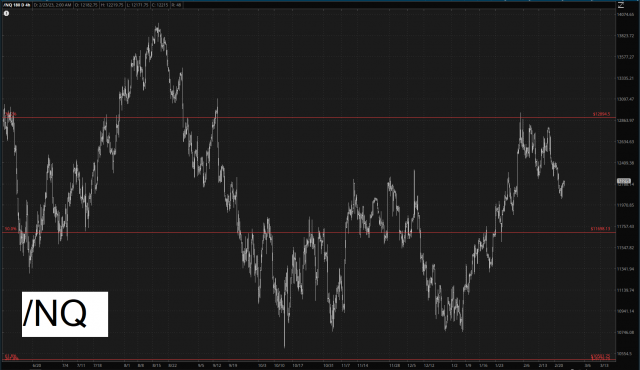

If you look at the bigger picture, this mega-rally in NVDA doesn’t mean squat. To be sure, the triple-digit gain on the /NQ as I am typing these words is welcome relief for our bullish buddies, but I think it will be, as the Fed might say, “transitory.”

Of vastly more import is the October 13th trendline on the /ES. We recently challenged this line, and support held so neatly that the quote data might as well have been saluting the red line as it approached. For about 15 weeks now, since that dreadful October 13th nightmare, the bulls have had this line as their principal ally. If we can manage to break it, that’s game over, man. Until then, the bulls continue to grip the baton, and we’re going to need some kind of jaw-punch, perhaps in the form of a meaningful exogenous event, to render this line moot.

I am posting this before the GDP comes out, and I have no idea if that data is going to matter to the market or not. For myself, I’m probably a tad too aggressively positioned in a couple of issues, but on the whole I’m all right with where I’m at. I’ve got about 12% cash, which I’ll probably goose up to 16% or so, and my portfolio remains, as always, utterly bearish with options expiring anywhere from June 16 through January 19th, an average of 157 days left.