Good morning, fellow Slopers, and welcome to a new trading week. In sharp contrast with last week, this one will be very light on………..everything. We don’t have an avalanche of economic data, the FOMC, the jobs report, or a billion earnings to deal with. We’ve gone from waiting breathlessly for the likes of AMZN and AAPL and instead contend merely with big white balloons being shot down by F-22s and earnings data from such nobodies as Vertex and Mettler-Toledo.

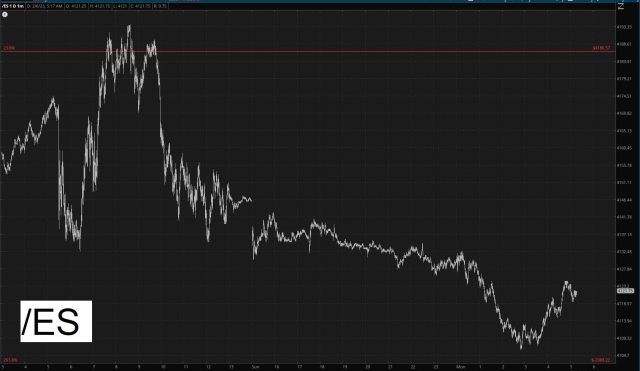

Right from the Sunday open, equities have been slowly slipping lower, although, in typical fashion, the sugar-addicted bulls have been trying to bid things up for the past few hours.

The bond market paints a true picture, showing a persistent rhythm of lower lows and lower highs.

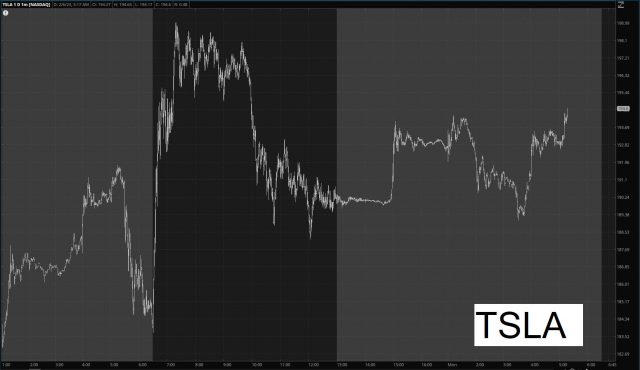

Oddly, Tesla remains stalwart, which I actually find encouraging. The reason I say that is because if equities can manage to bleed some red even while TSLA is resolutely strong, the moment TSLA begins to falter, things are going to fall to pieces. I’ll say this as many times as I have to: Tesla IS the market, and when it breaks, this whole nonsense that started January 6th is instantly over.

I enter the day with 20 bearish positions (the very earliest being a lone May expiration, and the average a massive 206 days) and almost 20% cash. We’re going to be putting the finishing touches on SlopeTalk this week and then will be turning our attention to other development matters to improve my beloved site.