NFLX has burned me countless times, so I’m not going to touch this one, but I’d like to suggest keeping an eye on the price gap at $470 as a reversal point.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Well, once again, my interest in the market is matching the VIX these days. I’m starting to just not care anymore, focusing instead on my latest engineering project, which isn’t subject which made-up numbers from the federal government. All the same, duty calls, and I’d like to point out that the leader all year long, NVDA, seems oddly non-participatory in yet another All Green Day.

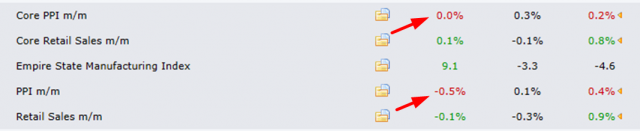

Fresh on the heels of yesterday’s gift-from-heaven-for-the-bulls CPI numbers, there was an even bigger tidal wave of data, and it was even BETTER news for our dear bullish friends. PPI came in at stone-cold 0%, way below expectations, and past data was revised LOSER. The month over month PPI was NEGATIVE and, likewise, past data was dropped. You would expect the /ES to be up about 400 points right now.

The rally which took place on Tuesday, November 14th, following the very weak CPI report, was one of the biggest events of 2023 for equity bulls, if not the biggest. The Dow rose almost 500 points, the S&P rose almost 100 points, and the Russell 2000 climbed an eye-popping 5.44%. Below are eight exchange-traded funds (ETFs) in particular interesting setups following this mega-rally.

We start with the small caps, which have been range-bound at this point for years. The Fibonaccis have had an extremely powerful influence, acting as either support or resistance, and in just the past couple of weeks, and IWM has rallied from one Fib (as support) to another (as resistance). The price is just about at the midpoint, which should provide a meaningful barrier to further price ascent without some important new catalyst to propel it over the midline.