Friday was always likely to be a retracement or consolidation day as I mentioned on Friday morning. SPX rallied to close at the IHS neckline and that was neither bullish nor bearish really. A strong Sunday night on ES to follow through would have been bullish, but ES has dropped to make marginal new lows at the moment. That delivers a potential W bottom on strongly positive 60min RSI divergence, but that's only IF we see a reversal back up here. If we see Thursday's low undercut by much during trading hours that will look bearish, and will become rapidly more so if we drop further as I was saying on Friday. Here's the setup on the SPX 60min:

Here's the potentially bullish setup on the ES 60min in the event that we see a reversal and get back over the Friday highs:

Other markets present a mixed picture here. I was saying on Friday that a retest of the lows on EURUSD looks likely and EURUSD is halfway there now which is cautiously bearish for equities. Against that I posted a Vix chart on twitter on Friday showing that the pattern setup there still looks bullish (for equities), though the second Vix Buy (equities) Signal last week failed to confirm again on Friday:

Friday's action on TLT was ambiguous. TLT closed back below the broken rising support trendline which looks possibly bearish, but the overall lean has to be bullish for bonds and bearish for equities as long as support in the 124 area holds:

Looking at the longer term charts silver hit rising support from the 2008 low on Friday, so we'll see what happens here. I've been reading a lot of talk about a target at 18-19 if we see a break down here, but there is a very strong support level in the 19.50 – 20 area that you can see on the chart so I'm doubtful about that. A break below 19.50 would open up a lot of potential further downside targets:

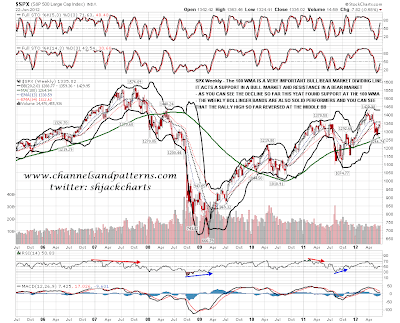

I've been posting my SPX daily charts with bollinger bands and the key DMAs a lot lately, so I thought I'd have a look at the weekly equivalent today. You can see that the bollinger bands are very good performers there too, with the middle bollinger band being important support in bull markets and resistance in bear markets. Worth noting therefore that the current rally high was at the middle bollinger band, which for other reasons previously given as well, was the obvious target. The MAs on the weekly chart are different, as I don't think that either the 50 WMA or the 200 WMA are important. The 100 WMA however is a key bull/bear dividing line and you can see that the two main lows in 2010 and the low so far in 2012 were at tests of the 100 WMA. The 13 and 34 weekly EMAs are also important and we have not yet seen those cross this year. A cross with a confidence is a historically reliable confirmation of a move between bull and bear markets, though that works best with a long topping process like the one in 2007/8:

On the bigger picture on equities there are a lot of analysts calling for lows slightly below the current 2012 lows, and that could fly if the lows are marginal and short-lived. If the new lows were made with any confidence however then the pattern setup suggests that we may well then see a VERY large further decline. There are valid potential double-top setups on SPX and Dow of course, which trigger much lower targets on a move below the June lows, but there are also a whole raft of huge reversal patterns on overseas equity indices (and copper and oil), which would by that stage be looking very bearish indeed. Here's the setup on MSWorld (main world equity indices excluding US) where you can see that there is a fully formed H&S pattern indicating to somewhat below the 2009 lows on a break below the neckline at the June low. A break below that neckline would be a really very bearish development:

ES is below Thursday's lows at 1315.25 as I write this and an open at this level would look bearish on SPX. A gap fill would however set up a bullish looking reversal setup that would trigger on a break above the Friday high. A continuation down would seriously damage the already wounded reversal IHS setup and a move below 1306 SPX will kill this off altogether. If we see that then a test of the June lows would look likely in my view.

On other news I'm part of a small group that has launched a new weekly newsletter on the markets called MarketShadows. This is interesting for me as, though I use many longer timeframe charts, I'm generally writing from a daily viewpoint, and it's an interesting change to write from a longer term viewpoint. As part of this I've started doing a weekly post at the MarketShadows website with charts that will mostly be taken from the post I do the following Monday. You can see the one I wrote on Saturday here and that includes my two main USD charts that I haven't included in the current post. When the post is up each weekend I'll be posting a link to it on twitter.