Obviously I've been posting a lot of seriously bearish looking long term charts in recent weeks, and I should take a moment just to emphasize that I don't think that it's time yet to buy in a large supply of ammunition and baked beans and head for the high ground in preparation for the end of the world as we know it. What I am saying is that these setups need to be borne in mind as part of the overall technical mix, and that these patterns being at a late stage of development, at a time when we are looking at the potential for the forced breakup of the eurozone and a string of possible sovereign defaults, is definitely something to think about. I'll be posting some more of these charts today looking at US equity indices.

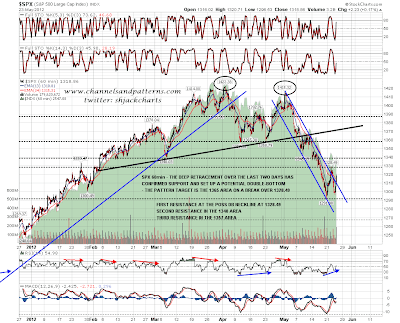

Short term however we have a distinctly bullish looking setup developing on SPX after the deep retracement from Tuesday's high. Obviously the declining channel from the high was broken on Tuesday, which was bullish. The deep retracement after Tuesday's high to establish a higher low has then set up a possible W bottom, which has a target in the 1365 area on a break over Tuesday's high at 1328.49. This setup also looks classically like a first wave up, followed by a deeply retracing wave 2, and that would put us currently in a wave 3 up so we'll see how that develops. There are a couple of other comments to add about this however.

The first comment is that I've mentioned before that 65% of potential double-bottoms or tops never get back to the pattern neckline, and that it's therefore not wise to take these too seriously before seeing a move back past there to trigger the pattern target. The second comment is that what happens after the pattern triggers is very important. In a strong bear trend bull patterns will often fail to make target and vice-versa. You may recall that the last double-bottom on SPX near the highs failed to make target and that was a good example. If we are still in a strong bear trend then this pattern too may well fail to make target. Equally if the pattern does make target, then that would be a significant signal that we may well no longer be in a strong bear trend:

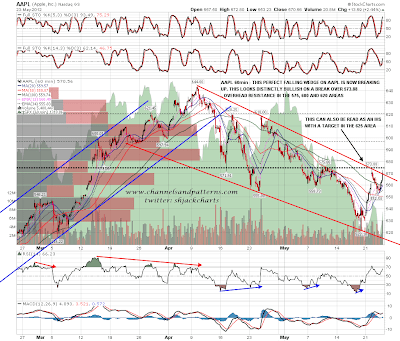

Is there anything to support this bullish setup? Well not much on EURUSD so far, but I've definitely got something on AAPL. I've been following the very nice falling wedge on AAPL this week and it confirmed as a strong pattern on Monday (three touches both trendlines) and has broken up yesterday. You have to be a bit careful with wedges as they have a nasty habit of breaking in one direction (overthrow) and then resolving in the other, but provisionally that break looks very bullish. What makes it look more bullish still is that this can also be read as a mostly formed IHS with a neckline in the 575 area. On a break over 575.88 I'd be looking for an IHS target at 625. If we see that move it would most likely be in the context of a strong general rally on equities:

The possible double-bottom on EURUSD that I was looking at yesterday morning died swiftly, and the only possible pattern I'm considering this morning is a currently wildly speculative possible IHS that might form at 1.282 resistance as the neckline. If that formed and played out it would target declining resistance from the February high but as I said, currently that's wildly speculative. The positive RSI divergence on the 60min chart is striking though, and if we were to see a strong rally on equities I'd expect EURUSD to at least stop falling much while that happened:

Well that's the cheery charts out of the way so I'll post some US equity indices for my apocalypse chart collection. It's a tougher call doing this for the US, unlike the rest of the world where most indices (that haven't already melted down) look to be on the verge of possible meltdowns, so my US charts are very selective and it should be borne in mind that on the Nasdaq and Wilshire 5000 particularly, there are no obvious large bear patterns forming. Of the indices where they can be seen, the NYA Composite is the largest and there is a decent looking H&S forming there with a target just above the 2009 lows. Worth noting though that the top of the right shoulder is close to the top of the head than the top of the left shoulder, so the symmetry of this pattern isn't great:

There's also a very decent topping setup on the Russell 2000, where the high this year was a perfect retest of broken rising wedge support from the 2009 low. There is a decent possible double-top setup from the 2011 and 2012 highs that would target just below the 2009 low on a break below the October 2011 low:

There's also a possible double-top setup on Dow, though the tops are 3.6% apart, which is within the 5% acceptable range, but too far apart to make this a decent potential pattern in my view. The target would be the Nov 2008 low in the 7450 area on a break below the October low:

The nicest technical setup however is on the SPXEW, the equal weighted SPX index, where there is a potential perfect double-top at the 2011 and 2012 highs, with both of those those tops at failed tests of the 2007 high. This is a nice looking setup, and if we see a break of rising channel support from the 2009 low in the 1775 area, then I would be looking at this very seriously:

For today my lean is bullish and I'm looking hard at the potentially very bullish setups on SPX and AAPL to see whether we see resistance breaks there. If we do then my lean will become more bullish. I have rising support from yesterday's low on ES just under 1310 and a break below that would throw the bull scenario into some doubt.

I have a request today. My brother is looking for decent track record 1X ETFs to short financials with. Suggestions welcome.