For a few weeks now, I've been almost completely in-synch with the market. The last couple of days have been a bit disappointing, because they went like this:

+ On Wednesday, I was up at my peak $X dollars (consider X a decent amount);

+ At Wednesday's close, I was down $X/2 dollars;

+ On Thursday, I was up as much as $X/2 dollars;

+ Then, at the close, I was down $X/4 dollars

So on both days, I saw a nice profit flip around into a loss half the size. Neither loss was horrible by any measure, but it's disspiriting to work hard and see green become red.

And, in each instance, it was a full-on-retard ES spike near day's end that did the damage. So, besides looking over my shoulder at all times for the Bernank, now I've got Euro-rumors to worry about.

Thus, I remain 50% in cash with the other 50% in a bewildering variety of small short positions. The Euro precisely reached my 1.25 target (and, for good measure, even dipped 5 pips beneath it), so objectively speaking, I've got to wonder if it's Euro-bounce time. My GLD and SLV hedges from last night were closed profitably this morning, but I really can't join the bull bandwagon right now.

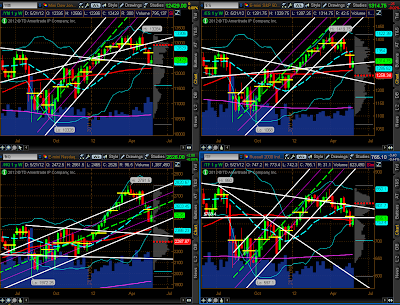

I continue to monitor the Russell 2000 closely; the head and shoulders formation is very well-formed, but it's unclear to me which neckline possibility (each of which I've tinted) will be reached. The depth of the Euro's sell-off urges me to remain cautious, so I'm not as fervantly bearish as I was in recent weeks.