Well, in just over two hours, the FOMC news will hit the wires, and we’re currently going through the same nonsense we go through eight times every calender year…………sitting on our hands and waiting for Ben’s Word. (You may find the blog new-post-free after the announcement, as I’ll probably be quite occupied……..but we’ll see).

Some day, precious metals miners are going to be incredible bargains, and whether that day is today or months from now remains to be seen. I actually bought some calls this morning, immediately burned my hand on that hot skillet, and closed ’em for a couple hundred dollar loss. I simply don’t have enough faith that metals are going to hold up. Precious metals are just about the only market that one can say are in an honest-to-goodness bear market (incredible as that must seem, considering the trillions in funny money that has been created over the past four years).

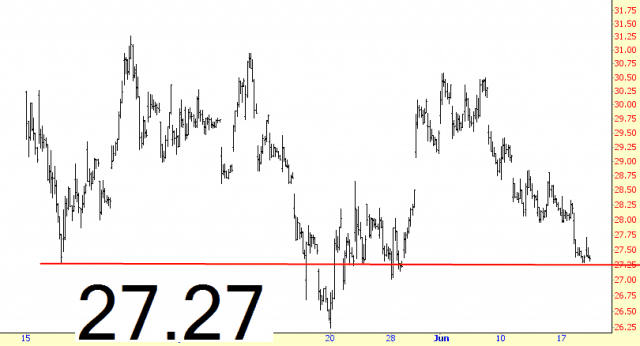

The price level 27.27, which may well be broken by the time you read this, is the strict technical limit for the inverted head and shoulders on GDX. Failing that, the price pattern goes bye-bye, and the next level to watch is 26.24. It that fails, well, goodness, metals have a lot further room to the downside.