Jack Dorsey’s Square scores with Bitcoin trading revenue, but its latest acquisition profits from the poor.

Silicon Valley Monetizes Precarity

Eight years ago, journalist Steve Sailer made an astute observation about Silicon Valley, that the “sharing” economy were really profiting from economic precarity:

In recent years, Silicon Valley fortunes have been made by taking yesterday’s depressing ways to eke out a few bucks — taking in lodgers, hacking a gypsy cab, selling your possessions, etc. — and giving them a 21st Century gloss. For example, Lyft and Uber would appear to be taxicab companies that employ you to use your own car, not theirs, to pick up strangers and drive them around. But Uber spokespersons deny that, explaining that Uber is actually a “ride-sharing smartphone app,” so it’s, like, awesome. Plus, Uber has an ironic name.

Similarly, airBnB enables you to turn your home into a boarding house. But, while you are scrubbing the toilet after your latest paying guest has departed, you can console yourself that some guys in Silicon Valley have made a fortune off this, so it’s actually much more glamorous and buzzworthy than it might appear at the moment from your perspective (on your knees in front of your second bathroom’s toilet bowl).

Sailer’s observation came to mind when we read that Twitter (TWTR) founder Jack Dorsey’s payments company Square (SQ) had agreed to acquire Australia’s Afterpay, a “buy now, pay later” company that caters to customers who want to buy products they can’t afford. Square shares were up 10.36% on Monday on news of that acquisition and Square’s earnings beat announced before the open.

Another Tailwind For Square

Over the weekend, we wrote that Bitcoin miner Riot Blockchain (RIOT) ought to do well if Bitcoin at least stayed within its recent range if it didn’t breakout to the upside; the same is likely true of Square. As ZeroHedge highlighted on Monday, Bitcoin is now 58% of Square’s total revenue.

So far, Bitcoin’s contribution to Square’s profits has been small, but it’s growing, as Andreessen Horowitz venture capitalist Rex Salisbury illustrates below.

A Top Name For Our System

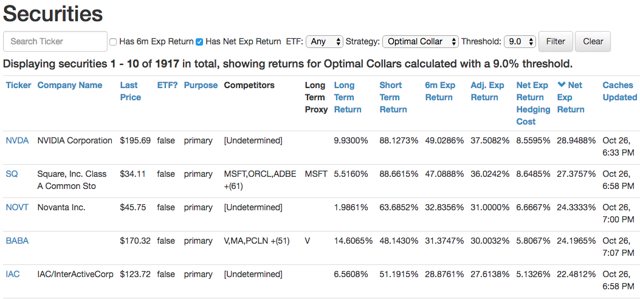

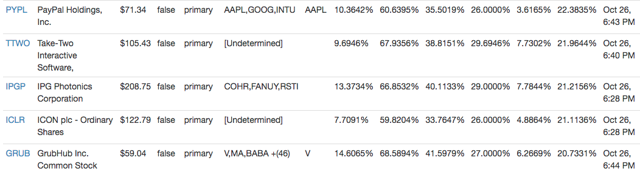

Square was a top ten name for our system last Thursday. It’s been a top name for us a number of times before, first popping up on our screens in October of 2017, when it traded at $34 and change.

Screen captures via Portfolio Armor on October 26th, 2017. Square was our #2 name that day.

Cathie Wood Sold The News Though

Two of Cathie Wood’s ARK ETFs sold over 280,000 shares of Square after the news on Monday.

In the event Cathie Wood called a top here, let’s look at ways Square shareholders who want to stay long can limit their risk.

Adding Downside Protection To Square

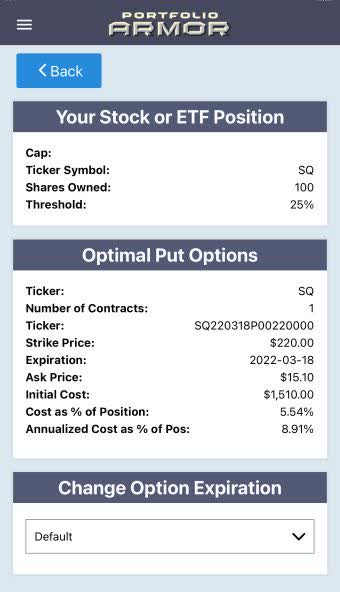

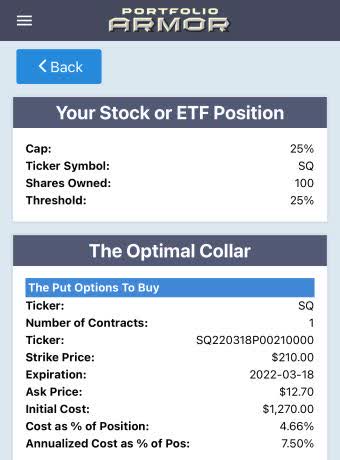

Here are a couple of ways of hedging against a greater-than-25% drop in Square by next March.

Uncapped Upside, Positive Cost

This and the subsequent screen captures are via the Portfolio Armor iPhone app.

The cost there was $1,510, or 5.54% of position value (calculated conservatively, using the ask price of the puts).

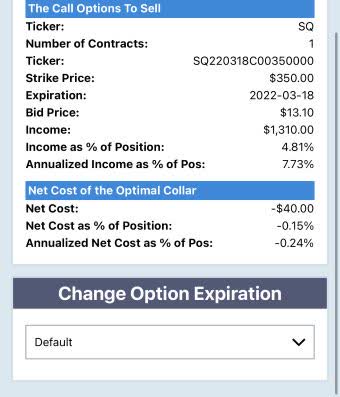

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 25%, this was the optimal collar to protect against a >25% drop over the same time frame.

This time the cost was negative, meaning you would have collected a $40 credit when opening this hedge, assuming, conservatively again, that you bought the puts at the ask and sold the calls at the bid. Since you could probably have placed both trades within the spread, your net credit would likely have been more than $40 here.