I’ll share this item:

The stock market has been on a tear in recent years, with major indexes reaching new all-time highs on a regular basis. However, some experts are warning that the market may be overvalued, and that investors should be cautious.

One of the main indicators of an overvalued market is a high price-to-earnings (P/E) ratio. This ratio compares a company’s stock price to its earnings per share, and a high ratio can indicate that a stock is overpriced. The S&P 500, which is one of the most widely-used measures of the overall stock market, currently has a P/E ratio of around 25, which is higher than the historical average of around 15. This suggests that the market as a whole may be overvalued.

Another indicator of an overvalued market is low interest rates. When interest rates are low, it can make stocks look more attractive to investors because they can’t get as much return on their money in other investments. However, when interest rates eventually rise, it can make stocks less attractive, and lead to a market correction.

The recent economic recovery after the pandemic have also pushed the stock market to new heights, but there are concerns that it is being driven by speculation rather than fundamentals. Some experts warn that the market may be in a bubble, and that it could eventually burst, leading to a sharp decline in stock prices.

Investors should be aware of these risks and consider diversifying their portfolios to minimize their exposure to the stock market. This may include investing in bonds, real estate, or other assets that are less affected by market fluctuations. Additionally, investors should be sure to do their own research and not follow the crowd when making investment decisions.

It’s important to note that the stock market is unpredictable and no one can predict with certainty when the market will correct or crash, but it’s important to consider the signs of an overvalued market and make informed decisions.

It’s also worth mentioning that, even though the market may be overvalued, it doesn’t mean that it will necessarily correct or crash in the short term, it’s possible that the market may continue to rise despite being overvalued.

In conclusion, while the stock market has been on a strong uptrend, there are signs that it may be overvalued and that investors should be cautious. It’s important to diversify portfolios and make informed investment decisions to minimize risk.

So what’d you think? Pretty bland, huh? Well, it’s no surprise. It took me about 2 seconds to create:

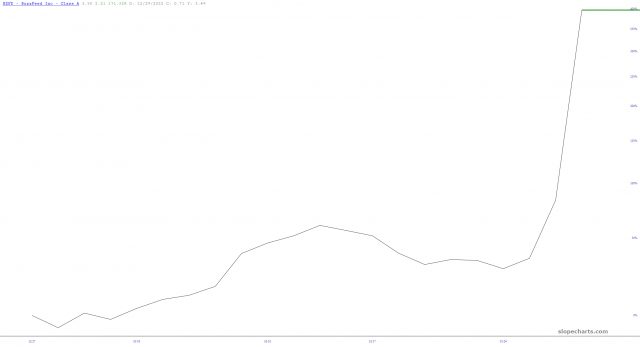

Not that Buzzfeed’s mention of using ChatGPT didn’t goose the price by 300% in a single day: