Friday morning kicks off Q4 2022 earnings season in earnest. I don’t have positions in any of these, but I’m glad we’re got some non-government news that’s going to drive the market, for a change.

(more…)

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Friday morning kicks off Q4 2022 earnings season in earnest. I don’t have positions in any of these, but I’m glad we’re got some non-government news that’s going to drive the market, for a change.

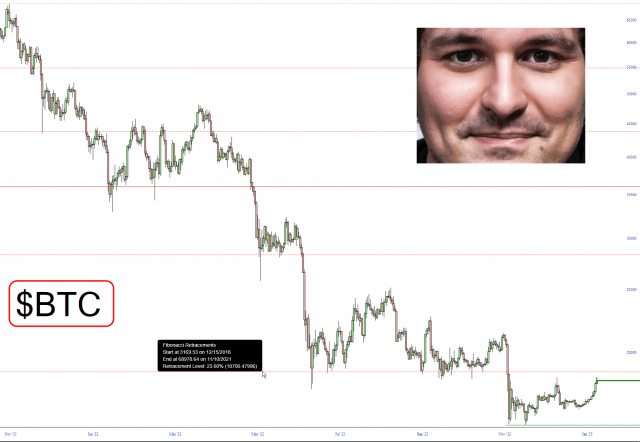

As I mentioned in a premium post last night, the alignment between crypto and stocks is remarkable, with a nearly perfect correlation between two ostensibly different asset classes. I would suggest that the price levels I have highlighted below (in the back boxes) are important levels of resistance for what has been (in the case of both stocks AND crypto) a very powerful multi-month run higher. As always, click on an image to see a larger version.

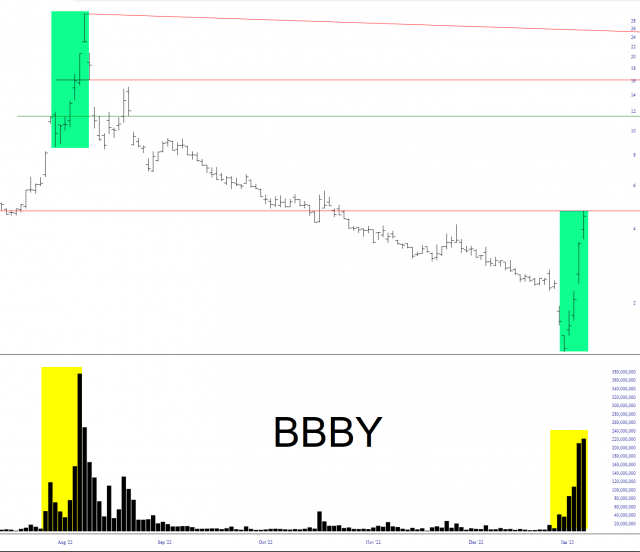

As LZ pointed out today, the last time the garbage stock Bed Bath & Beyond (BBBY) was treated like God’s gift to equities, the market precisely top-ticked its massive rally. I pray to heavenly father we see a repeat of the same thing, thanks to the signal this junk stock is offering.

No, I’m not referring to the market for the past four months. It has to do with a Christmas gift. See, my kids know I like Bob Ross, so one of them got me a Bob Ross chia pet. The idea is that you slather a bunch of wet chia seeds all over his hair area, and in a week, he’s got a cool bushy green afro. But I thought the little bust of Bob was fine as-is, so I just spray painted it white (it starts off as that reddish-brown of ceramic pots) and just put him in my office.