The Recent Metals Action Is “Causing” Me To Change My Life

I have made a ground-breaking discovery this past week. It is so earth shattering, that it will literally change the course of my life, and may cause you to change yours as well. Let me explain.

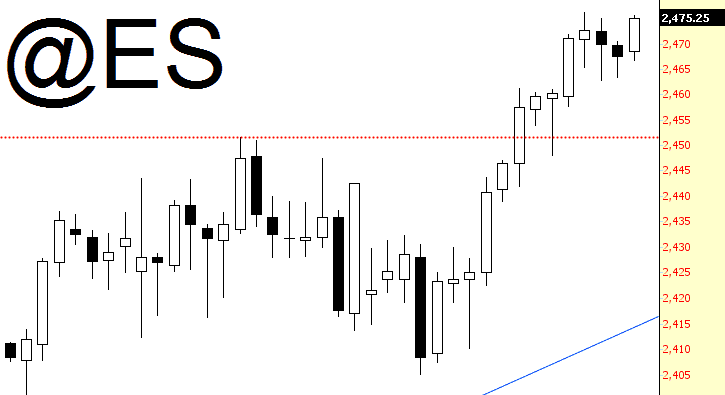

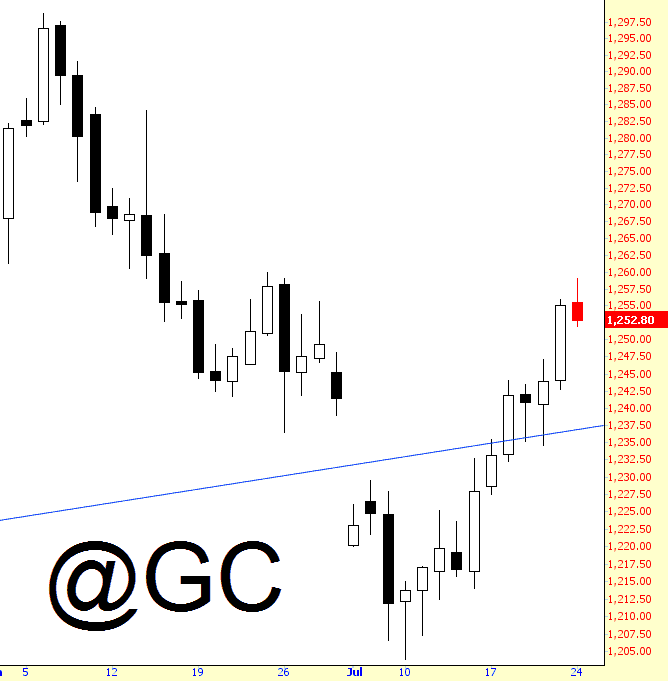

Maybe you believe that the stock market volatility was the reason the metals rose? Well, the S&P500 is within 2% of its all-time highs, yet the metals have continued to rally alongside the market.

And, maybe you believe that North Korea is the reason that the metals have rallied? Well, I have dealt with that issue last week, so I do not have to re-address it here again. But, suffice it to say that anyone who has really followed geopolitical events will know that gold has moved in completely opposite directions during such tensions through history, and they will never provide directional guidance for the metals. (more…)