Apologies for the late post today. A very busy morning.

The FOMC news today is likely to be that there is no news, that interest rates won’t be rising this month, and there’s no press conference after 2pm to add spin to the announcement. Nonetheless markets will likely move on this absence of news, and I’ve been considering which way that might go. The bad news though is that there are decent setups in both directions here.

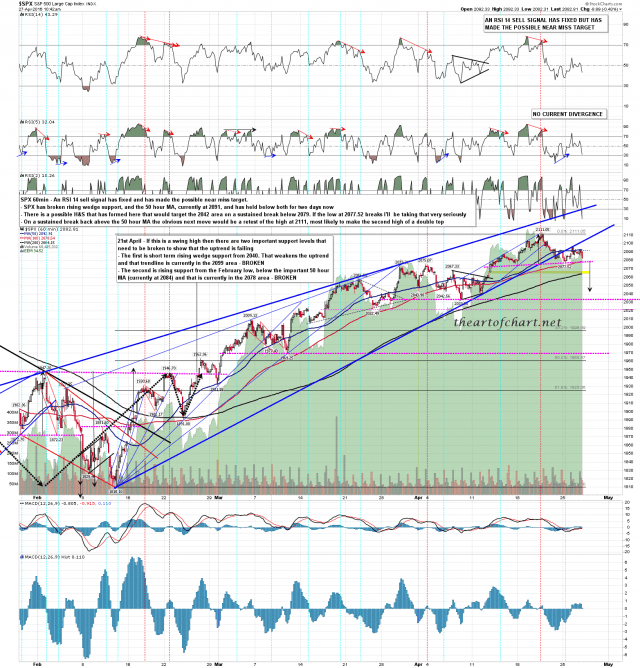

On the bear side there is a clear setup on SPX for a break lower from an H&S that has mostly formed now. On a new retracement low below 2077 then an H&S would be breaking down with a target in the 2042 area. SPX 60min chart:

On the bull side there is an equally clear IHS that has mostly formed on ES at a 2091 neckline. On a break up the IHS would have alternate targets at either a retest of the current swing high at 2105 or a marginal new swing high at 2112 (ES). ES Jun 60min chart:

Stan and I are favoring the bull scenario here unless the current retracement low at 2077.52 SPX is broken. On a sustained break back over the 50 hour MA at 2093 SPX then I’ll be looking for a retest of the current swing high at 2011.05 SPX and likely a marginal new high in what should be the second high on a double top.