According to my Stock Trader's Almanac, the week after July opex leans bearish, with Dow down 7 of the last 12. Mondays have been modestly bearish too in recent months, though only 5 of the last 10 have closed down so I'm not treating today as bearish leaning. My feeling is that we should see a decent break up soon, though we might see a move down to make a lower low before then. That's a maybe though as support on ES in the 1303.25 area has held on 12 hourly candle tests since last week's low at 1295.25:

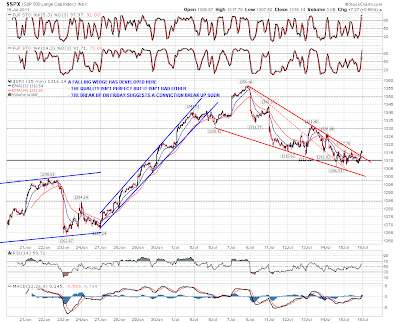

Looking at the trading hours charts, SPX is looking pretty bullish to my eye, with a reasonable quality falling wedge that was breaking up at the close on Friday. It looks like SPX will open back within the wedge at the open today but I'd be looking to a second break up through resistance to trigger a decent rally:

There's a similar falling wedge on the Dow as well, though that wedge has not yet broken up. The Dow wedge has a very good support trendline that I'd be expecting to hold on any push downwards today:

TF is still in the declining channel that I posted last week. with some solid looking support in the 822.75 – 833.5 area:

NDX hasn't formed a particular pattern really, but there is a decent resistance trendline as with the others. That trendline broke up on Friday though it may well open back below today:

I posted the possible IHS on SLV last week and suggested that might carry SLV through gap resistance, which it did. I'm wondering now whether SLV has bottomed and next resistance is at 39, with the IHS target at 39.2:

EURUSD is in a tight declining channel, and I'm watching that channel for a break up. On the USD charts of course there is every sign that USD has made a major low, so I'm not looking for any huge rally on EURUSD:

I think that the falling wedges on SPX and Dow are telling us that we're close to a short term low on equities here, and am expecting a strong move up soon. Whether that will be a strong move up to new highs is open to question. Summer rallies tend to be week and there are many clouds hanging over this market. A possible trigger for a strong rally is the US debt ceiling negotiations which may conclude this week.