Last night when I was about to go to bed I posted a very nice looking bull setup on ES with a falling wedge that had broken up, an IHS that had formed at, and was breaking up through, the important 1257 resistance level. That failed in the mid-1260s though, the 1257 level was rebroken and ES has been as low as 1240 overnight. This obviously looks a lot less bullish, and I'm wondering whether we'll see a move to test the broken wedge resistance trendline near yesterday's low:

On the SPX, NDX, and RUT charts I now have three very similar broadening descending wedges. The next obvious moves on these wedge are up to hit the upper trendlines, but it's worth noting on the SPX 60min version that it is the 13 EMA that has mainly been acting as resistance on this move down, and that SPX hit the 13 EMA at the close yesterday:

That isn't as clear on the NDX or RUT charts however,and the next obvious trendline hit would be the upper trendline. Here's the NDX 60min version:

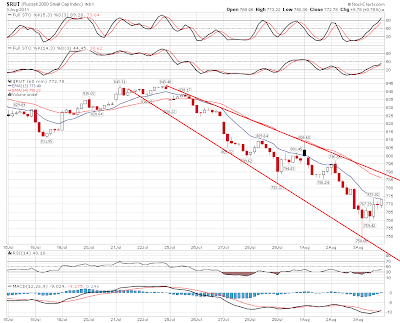

Here's the RUT 60min version of this wedge:

I'm wondering if we will need to hit the key support level in the 1219 SPX area before we see a strong bounce here. If this down move is the start of something bigger, as I think it is, then I'd expect to see a bounce off this support area before a return to break it. Here's the SPX 6yr chart to show how important a support / resistance area this has been over the last few years:

On the three year SPX chart I've shown this support level more clearly, and it's also well worth noting the RSI is hitting 30 on the daily chart as well. RSI has held 30 at every hit since March 2009, and that's another reason to expect at least a bounce here. What I've also shown here is my preferred target for a bounce, which would be a kiss of death retest of that rising wedge lower trendline, which has only two hits so far and needs a third to properly confirm the trendline:

I've heard some talk that this big move down is related to contagion fears on Euro-zone debt, but I don't think that the currency action this week particularly is backing that up. EURUSD has weakened somewhat since Monday, but has been successfully clinging to the 1.427 support / resistance area:

That's in sharp contrast to AUDUSD, which has crashed almost 5% since the start of the week and looks set to fall further. A move to big support in the 1.04 area looks likely:

What does this sharp relative underperformance from AUDUSD suggest? Well, it suggests that the main concern here is that the US is close to a double dip recession, and there's good reason to think that. Here are the GDP figures since Q3 2009:

- 1.7

- 3.8

- 3.9

- 3.8

- 2.5

- 2.3

- 0.4

- 1.3 (not revised down yet)

Not an inspiring series and close to levels which in the past have almost always been followed by recessions. On average equities fall by 40% in recessions, or so I have read, so fear of recession is a very rational reason for equities to be falling sharply.

I have mixed feelings about the outlook for today. I will be strongly bullish if SPX gets below 1230.